📢 March Signals

🗓️ Key dates to watch

- Every day – GBTC outflows and net ETF inflows

- 28 March – Core PCE & GDP growth (final)

- 3/5 April – Jobs data JOLTs/ Non Farm Payrolls

- 10/11 April – US CPI/PPI

- 19 April – The 4-year Bitcoin halving event!

🗓️ Fundamentals

- Cathie Wood says Bitcoin could go as high as $3.8 million

- London Stock Exchange will start market for Bitcoin and Ether ETNs May 28

- BlackRock enters asset tokenization race with new fund on the Ethereum Network

- Solana activity flips Ethereum amid memecoin craze, even as txs fail

- Bitcoin price reclaims $70K as Coinbase BTC supply hits 9-year low

🗓️ Market update

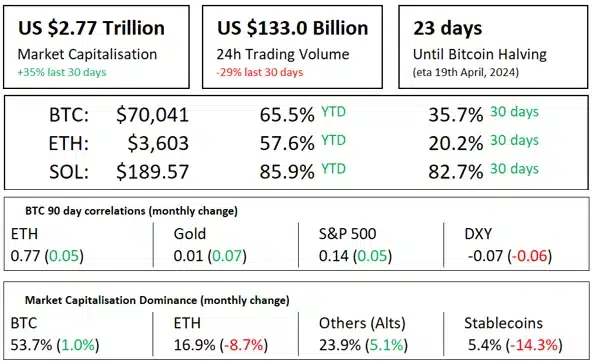

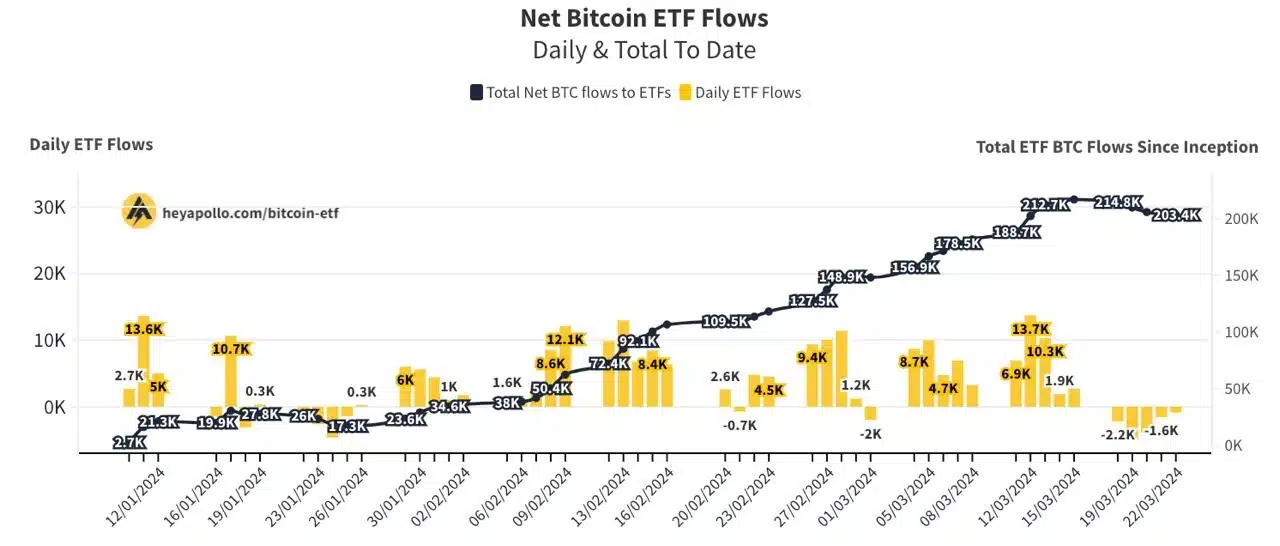

Despite a mid-month sell off BTC is still up 13% month to date. GBTC outflows ticked up such that flows were net negative every day last week, GBTC has now lost 45% of their BTC, falling from 620k to 347k. One way or another this sell pressure stops soon at the current rate there is only 4 weeks left until there is none left. Last week $1.8Bn flowed out of GBTC while the 9 new ETFs received $1.2Bn in flows, and data suggests that very little of GBTC outflows are heading straight into the new ETFs, this is predominantly ‘new’ demand. GBTC outflows did slow throughout the week, and we are closely watching to see if that trend continues into this week.

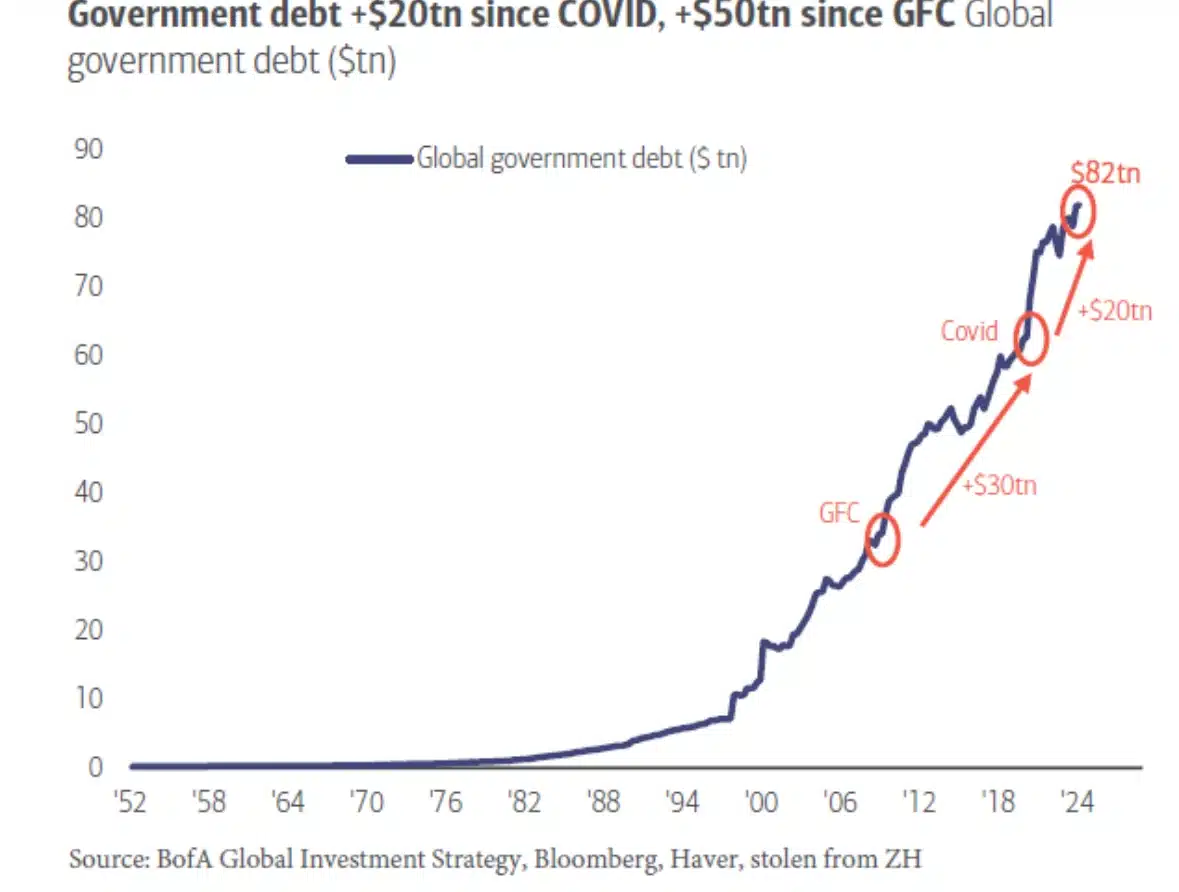

US CPI and PPI came in a little over estimate in the last 2 prints leading to the Fed pushing back their rate cuts, and the market also trimming their expectation. A third overshoot in a row could roil risk assets a little however we believe this would be temporary for crypto for a couple of reasons, 1. ETF flows are likely to remain solid, $100Trn of capital (i.e. the US equity market) is chronically under exposed & need to allocate no matter what, 2. The bitcoin halving event due to occur on 19 April, a very important supply/demand factor that has proceeded every bull market to date, and 3. fiscal dominance, I talk about this with Chris Judd (link below), fiscal spending is so large right now monetary policy must take a back seat, over the weekend the US signed another $1.2Trn debt bill to keep the government operating, at its current rate the deficit for the fiscal year will be $3Trn (vs $1.6Trn Congress est.). The best protection from this inflation inducing situation is owning hard assets like Bitcoin.

People often ask me how high will bitcoin go? I don’t like to speculate with hard targets, but one thing I’ll very happily say is the direction of travel is clear, as long as governments are recklessly spending, and central banks are mandated to debase their currency (even if just by 2% p.a.) then the price of bitcoin will trend up. The greatest threat to bitcoin is governments around the world becoming fiscally responsible and issuing a hard currency for their economy to use, from where I sit this is a long way off so expect BTC going a lot higher for a lot longer.

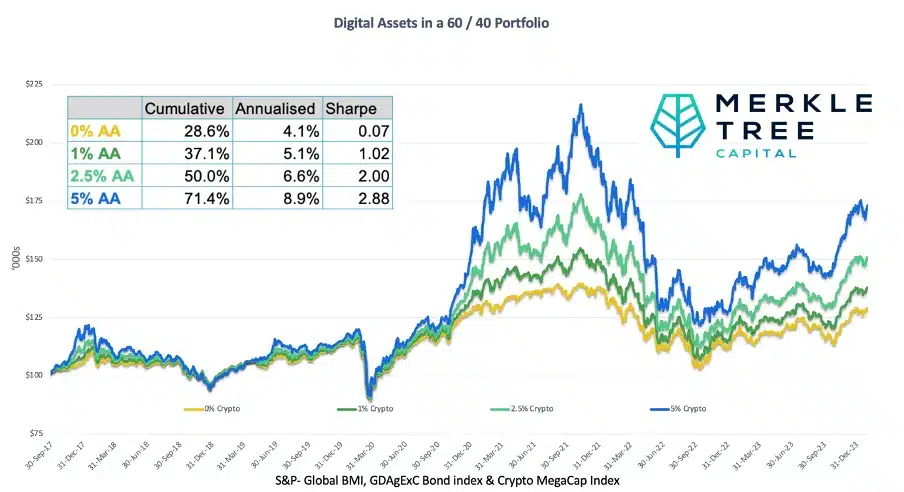

▶️ Talk Ya Book | Ryan predicts a further surge in crypto

Ryan McMillin from Merkle Tree Capital joined Chris Judd on Talk Ya Book this week. Ryan predicts a further surge in crypto driven by increasing liquidity, strong flows from the BTC ETF’s and further real life use cases. He further shares his take on allocating a small portion of your investment portfolio to cryptocurrencies as a safeguard against monetary inflation.

💡 Unlocking opportunities: Diversify your SMSF with digital assets

The digital asset landscape offers exciting opportunities for investors, including those with SMSFs. However, navigating the complexities and challenges of direct digital asset ownership within an SMSF can be daunting.

The investment landscape is always evolving, and as investors, it’s essential to adapt and keep up with or ahead of trends wherever possible. One such transformation is the growing interest and utility in digital assets, however this can present some issues operationally for SMSFs. Let’s explore the benefits of adding a small exposure to digital assets and the additional benefits for wholesale investors of allocating through a digital asset fund as opposed to holding tokens directly.

The Merkle Tree Capital “Why?”

We know accessing the digital asset sector is challenging, presenting a new set of risks that most investors are not familiar with, and there is a lot of sub-standard information flying around. That is why we created an actively managed unit trust aiming to hold the best digital assets that will form the basis of the ecosystem over the next 5-10 years.

Investors can now access this new asset class without concerns around self-custody or dealing with unknown counterparties, simplify their tax reporting, avoid single asset risk, maximise yield, and access institutional risk management and portfolio construction.

SMART – actively managed, enhance risk adjusted returns, sophisticated portfolio construction, staking yield, simple exposure – no passwords or digital wallets

SECURE – institutional custody, staking in cold storage, insurance, counterparty due diligence

CRYPTO – Blockchain eliminates intermediaries, lowers costs and improves efficiency by bringing transparency and security.