The digital asset landscape offers exciting opportunities for investors, including those with SMSFs. However, navigating the complexities and challenges of direct digital asset ownership within an SMSF can be daunting.

The investment landscape is always evolving, and as investors, it’s essential to adapt and keep up with or ahead of trends wherever possible. One such transformation is the growing interest and utility in digital assets, however this can present some issues operationally for SMSFs. Let’s explore the benefits of adding a small exposure to digital assets and the additional benefits for wholesale investors of allocating through a digital asset fund as opposed to holding tokens directly.

The Digital Transformation of Investments

Blockchain and distributed ledger technologies have so many novel applications whether it is removing counterparty risk and associated fees, rebuilding the internet such that our personal data isn’t harvested and sold to the highest bidder, digitisation of Real World Assets (RWA) allowing TradFi assets to trade 24/7, or just providing a digital savings technology that protects us from inflation.

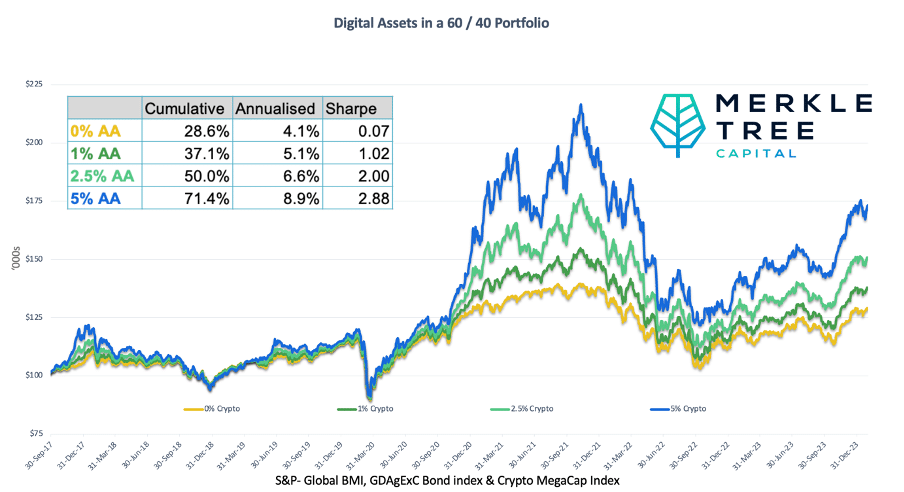

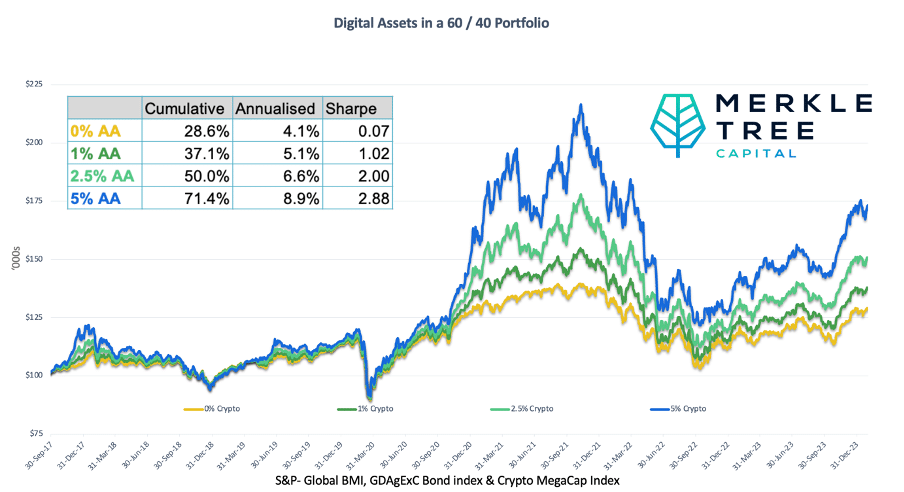

One thing is certain, adding a small amount of this new asset class to your portfolio has historically enhanced your risk adjusted returns, and significantly improved total returns, this is of course unsurprising that added a new and uncorrelated asset to a portfolio will enhance it. The question really is how much, this is a risk equation for each allocator understanding their time frame and risk profile, our research is as follows for a 60/40 portfolio adding a 1%, 2.5% and 5% allocation to digital assets.

However, investing directly in these assets within an SMSF can be challenging and may not align with the regulatory framework governing SMSFs.

Challenges with direct digital asset holdings in SMSFs

- Regulatory Complexities: SMSFs are subject to strict regulations, and trustees must ensure their investments comply with the Australian Taxation Office (ATO) rules. Direct ownership of digital assets can pose regulatory challenges, as the ATO’s guidelines for cryptocurrencies are continually evolving.

- Security Concerns: Holding digital assets directly in an SMSF requires secure storage solutions to protect against theft or loss. Managing private keys and ensuring compliance with security measures can be burdensome for SMSF trustees.

- Valuation and Reporting: Accurate valuation and reporting of digital assets can be challenging. Trustees must regularly update the asset’s value to comply with SMSF reporting requirements.

- Tax reporting: Navigating the tax implications of cryptocurrency investments can be intricate and time-consuming. Activity like staking can make tax reporting very complicated and could run afoul of the clear ownership test.

The digital asset fund solution

To overcome these challenges and provide SMSF trustees with a simplified way to access the potential benefits of digital assets, a digital asset fund, like the MTC Digital Asset Fund. An Australian based unit trust provides a structured and compliant vehicle for SMSFs to gain exposure to the digital asset market.

Benefits of Investing in digital asset fund

- Regulatory Compliance: A wholesale unit trust structured to adhere to SMSF regulatory guidelines, ensuring trustees’ peace of mind regarding compliance with ATO rules.

- Professional Management: Experienced professionals manages the fund, handling all aspects of asset selection, security, and reporting, reducing the burden on SMSF trustees.

- Diversification: By investing in a unit trust, SMSF trustees gain exposure to a diversified portfolio of digital assets, spreading risk across different tokens, themes and strategies.

- Simplified Reporting: A digital asset fund provides transparent and standardised reporting, making it easier for SMSFs to meet their reporting requirements.

- Enhanced Security: Most funds like ours leverage institutional custody solutions, at MTC we have chosen Coinbase’s institutional offering which we believe is the best in the industry and includes insurance coverage by Lloyds of London.