With the Bitcoin halving event around 12 months away it’s worth understanding the implications of reducing the supply of an asset that is often considered a commodity or form of digital gold.

The Bitcoin halving is an event that occurs roughly every four years (actually every 210,000 blocks), in which the reward for mining a new block on the Bitcoin blockchain is reduced by half. This event is hard-coded into the Bitcoin protocol and is designed to limit the supply of Bitcoin over time. The purpose of this mechanism is to control inflation and increase scarcity.

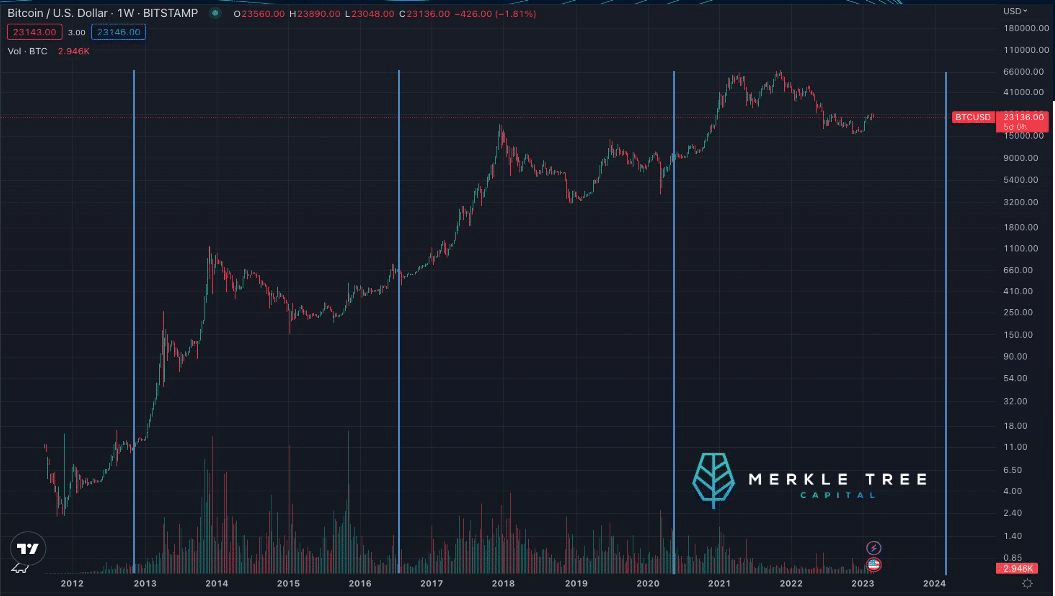

To understand the Bitcoin halving cycle and its impact on price, it’s helpful to look at historical data. There have been three Bitcoin halvings to date, 2012, 2016, and 2020, and each has had a noticeable effect on the price of Bitcoin.

In the lead-up to each halving, Bitcoin’s price tends to increase as investors front run the supply shock. In the months leading up to the 2012 halving, Bitcoin’s price increased from around $5 to over $12. Similarly, in the lead-up to the 2016 halving, Bitcoin’s price increased from around $200 to over $700. In the months leading up to the 2020 halving, Bitcoin’s price had been steadily increasing, from around $7,000 in January to over $10,000 in February and March.

After each halving event, Bitcoin’s price has tended to appreciate. In the 18 months following the 2012 halving, Bitcoin’s price increased from around $12 to over $1,100. Similarly, in the 18 months following the 2016 halving, Bitcoin’s price increased from around $700 to over $20,000. 19 Months after the 2020 halving Bitcoin reached a new all-time high of $69,000.

The Bitcoin halving cycle has played a significant role influencing performance over its 14-year history along with other important factors like global liquidity and global regulation, which, incidentally, we believe will all turn in Bitcoin’s favour through the course of this year. While past performance does not guarantee future results, we believe that probabilistically the next Bitcoin halving, expected in March 2024, will have a strong positive impact on the market.

Please reach out if you like to understand more about the halving cycle or or any other drivers of crypto asset price appreciation.