🎅 A Merry Christmas to our community from the Merkle Tree Capital team! We would like to extend our sincere thanks to you for your phenomenal support throughout this year. We are very much looking forward to recharging the batteries over the Christmas / New Year break and returning fully energised for what we believe will be a massive 2024!

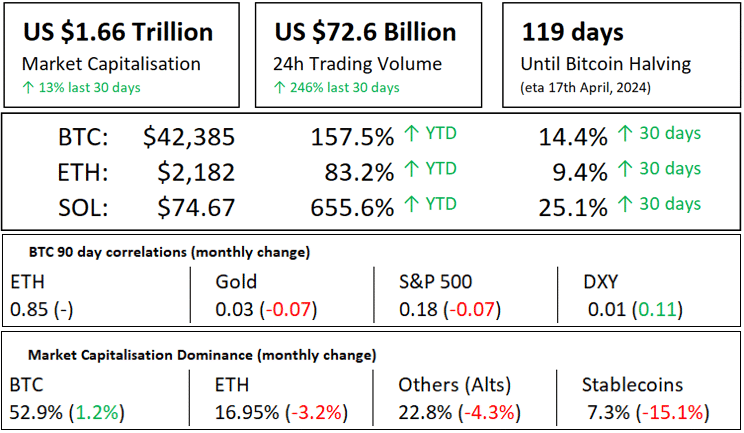

The fund returned 17.2% vs Bitcoin 11.3% vs S&P Crypto Top 10 Equal Weight index 16.1% for the period 30 November to 15 December. Year To Date the fund is up 116.6%.

📢 December Signals

🗓️ Key dates to watch

- 21 December – US GDP Growth (final) Q3 (this has the potential to be big, the first estimate spurred the current everything rally).

- 22 December – CORE PCE

- 4/5 January – JOLTS / Non Farm Payroll

- 8-10 January – SEC spot BTC ETF approvals

- 11 January – US CPI

- 11/17 January – US Treasury bond auctions 30 year / 20 year

⚒️ Fundamentals

- Coinbase CEO: Coinbase plans to integrate Solana

- Google updates its crypto ad policy ahead of possible bitcoin ETF approvals

- FASB Confirms ‘Fair Value’ Approach for Corporate Crypto Holdings

- Bitcoin won’t be beaten as digital store of value: VanEck CEO

- Immutable launches ‘Passport’ wallet infrastructure with Google or Apple login

Get in touch to discuss how digital assets fit in your portfolio:

www.merkle.com.au or [email protected]

🗒️ Year in Review & 2024 Predictions

How did our predictions from December 2022 go?

1. Regulatory clarity – 50/50 we did predict no bills would pass in 2023, and we did see rules published in the EU, UK, HK & Australia, but we had hoped for more from the US, the judicial system gave the industry several high profile wins against the SEC, but nothing out of the law making branch of government, this probably continues until after the 2024 elections.

2. 1 billion NFT owners – epic fail… the corporates who are dabbling in this space really didn’t come to the party on this one, we could see this pick up pace in 2024 as interest in NFTs heats up with the rest of the sector.

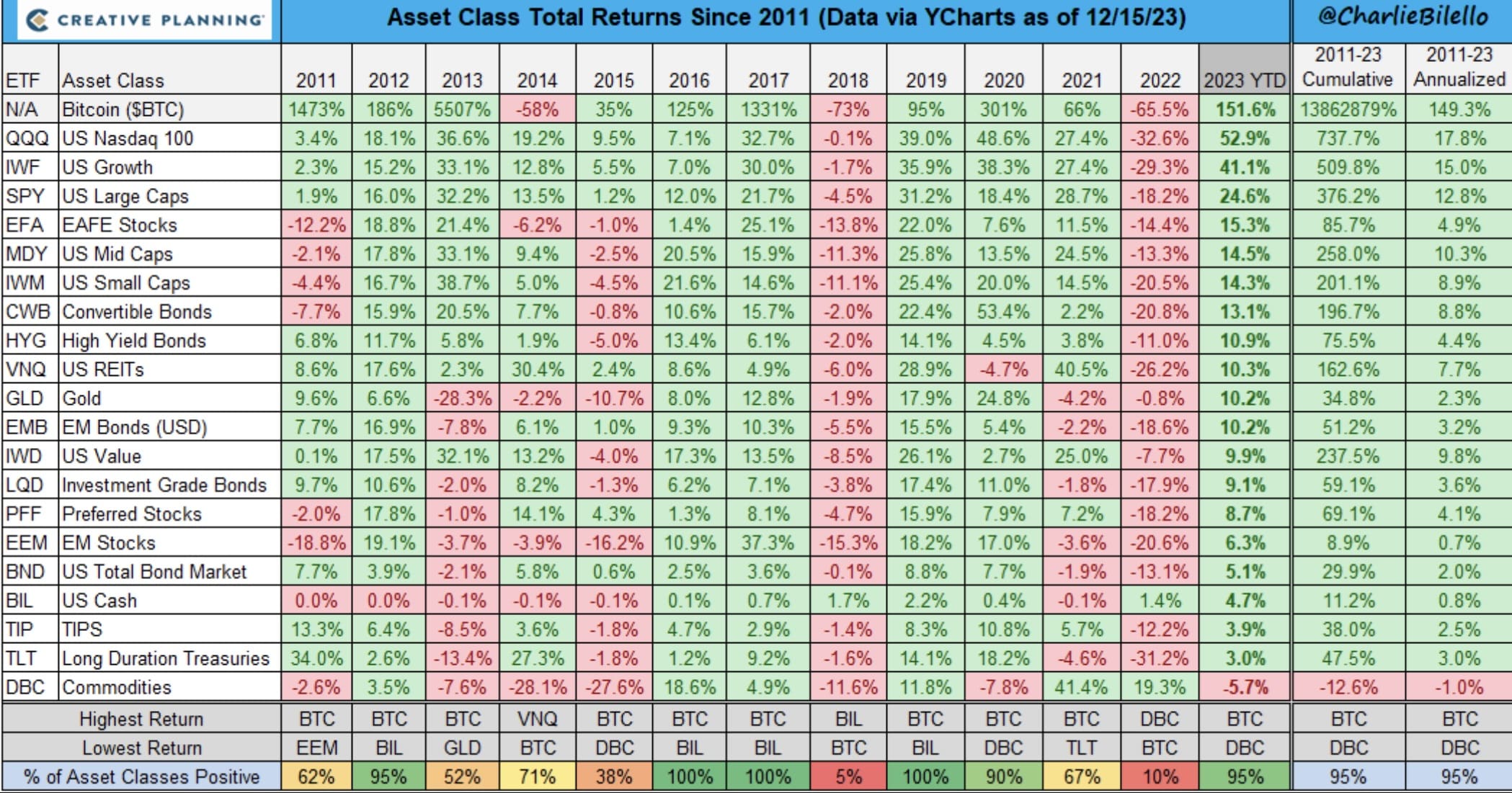

3. Bitcoin to outperform all asset classes – nailed it. Nearly 100% outperformance of the next best asset class, the NASDAQ, with just 2 weeks left in the year happy to chalk that up as a win.

4. Web 2 co-opts Web 3 – 50/50 while Google has some ties with Solana and AWS some with AVAX this still hasn’t completely played out.

Our 2024 Predictions

1. BTC again is the best performing asset class (per the above table) in 2024 and reach reaches a new all-time high (US$69k). And while on BTC, the spot ETF launches are collectively the most successful ETF launches in history.

2. Solana outperforms Ethereum – Solana’s performance and low cost see more new projects building on Solana. ETH will upgrade to be faster and cheaper, but Firedancer will put SOL in another universe of performance.

3. Breakout blockchain game – a game reaches 1m daily active users, is not based on a ‘play to earn’ or similar structure but rather a AAA game that gamers enjoy playing integrating tokenomics or NFTs as a feature rather than the main event.

4. DePIN – Decentralised Physical Infrastructure Networks hit mainstream consciousness in 2024, cheaper, user owned decentralised services for data storage, compute power, wifi, maps etc. Having built up through the bear market under the radar these networks will finally show mainstream the power of blockchain and decentralisation.

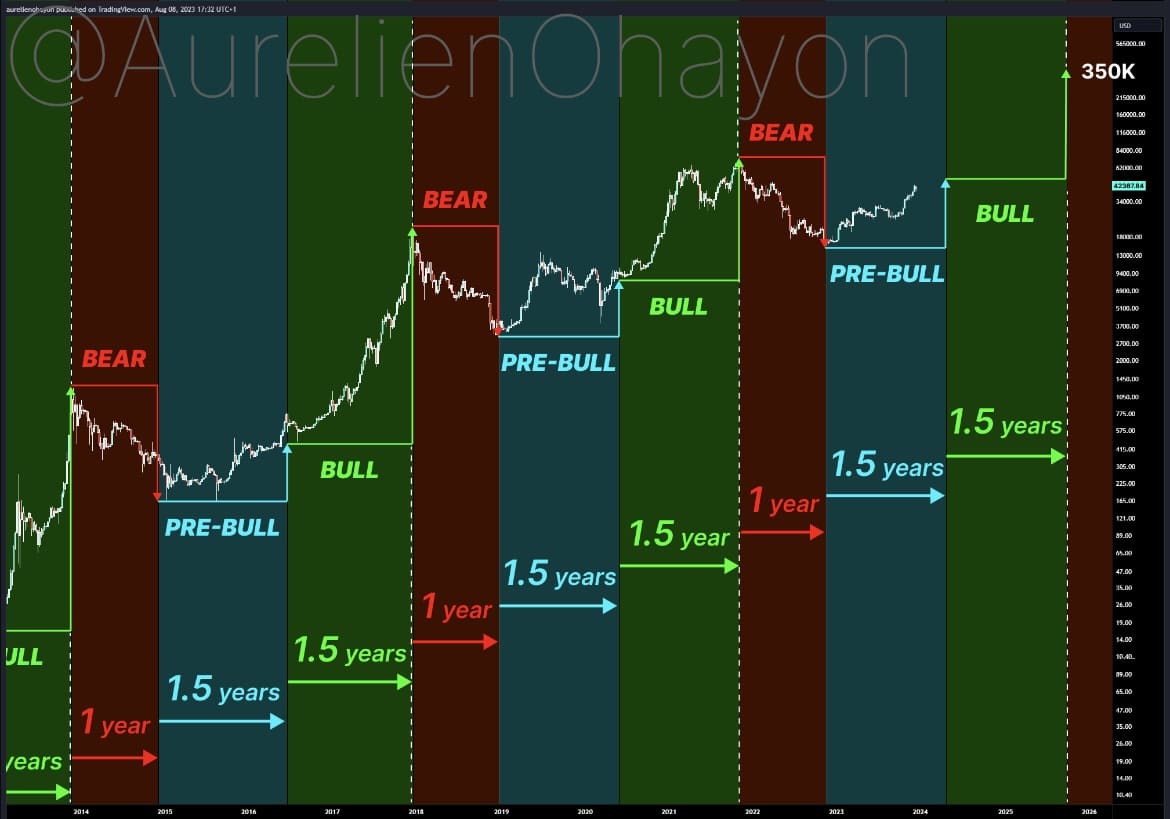

📈 Chart of the Month

Another take on the 4 year crypto cycle, we prefer to cut into 3 equal phases but it is the same story. The cycle is built around the halving event and the trend remains unbroken.

▶️ Podcast of the month

Ryan Selkis Shares His 2024 Crypto Predictions

Ryan Selkis walks through his crypto thesis for 2024. He covers big investment themes, people to watch, the future of stablecoins, policy takes and so much more in this wide ranging Bankless episode.

Click here to listen to the Podcast

The Merkle Tree Capital “Why?”

We know accessing the digital asset sector is challenging, presenting a new set of risks that most investors are not familiar with, and there is a lot of sub-standard information flying around. That is why we created an actively managed unit trust aiming to hold the best digital assets that will form the basis of the ecosystem over the next 5-10 years.

Investors can now access this new asset class without concerns around self-custody or dealing with unknown counterparties, simplify their tax reporting, avoid single asset risk, maximise yield, and access institutional risk management and portfolio construction.

SMART – actively managed, enhance risk adjusted returns, sophisticated portfolio construction, staking yield, simple exposure – no passwords or digital wallets

SECURE – institutional custody, staking in cold storage, insurance, counterparty due diligence

CRYPTO – Blockchain eliminates intermediaries, lowers costs and improves efficiency by bringing transparency and security.