📢 January Signals

🗓️ Key dates to watch

- Every day – GBTC outflows

- 25 January – US GDP Growth QoQ (advance estimate)

- 31 January – JOLTS US Job Openings

- 1 February – FOMC Meeting

- 2 February – Non Farm Payrolls

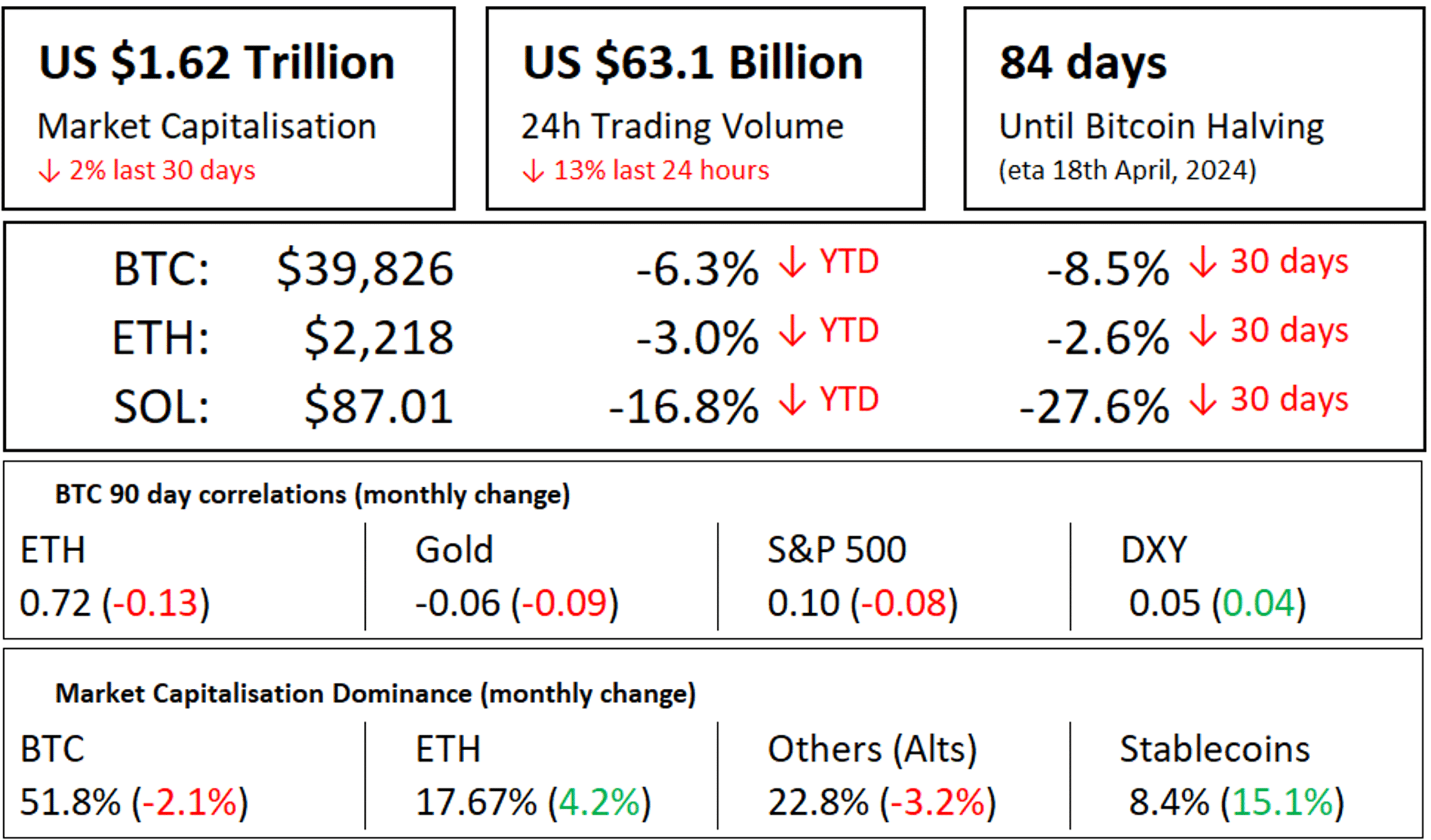

⚒️ Fundamentals

- Render is Switching to Solana After 10x-ing This Year

- Spot Bitcoin ETFs Explained: Everything You Need to Know

- FTX estate sold most of its Grayscale Bitcoin Trust Shares: Report

- SEC delays decision on Fidelity’s proposed spot Ethereum ETF to March

- 9 spot Bitcoin ETFs buy 100K BTC in 7 days after launch

Get in touch to discuss how digital assets fit in your portfolio:

www.merkle.com.au or [email protected]

🗒️ MTC DAF top performing & ETF analysis

Per Morningstar data MTC Digital Asset Fund at 128.5% for 2023 is the 3rd best performing fund in Australia across all categories, 2nd if you exclude a BTC only offering. A fantastic result as we head into a very positive environment in 2024, with bitcoin halving, global liquidity increasing and new investor flows via ETFs. A great time for all investors to look a bit closer at digital assets.

It’s something of an understatement to say lot to unpack on the BTC ETF landscape! Kicking off with the SEC’s offical Twitter/X account hacked reporting approval a day before the real approval (only in crypto) and 2 of 5 SEC commissioners still voting against approval after the courts had settled this issue labelling denial capricious and arbitrary and unlawful.

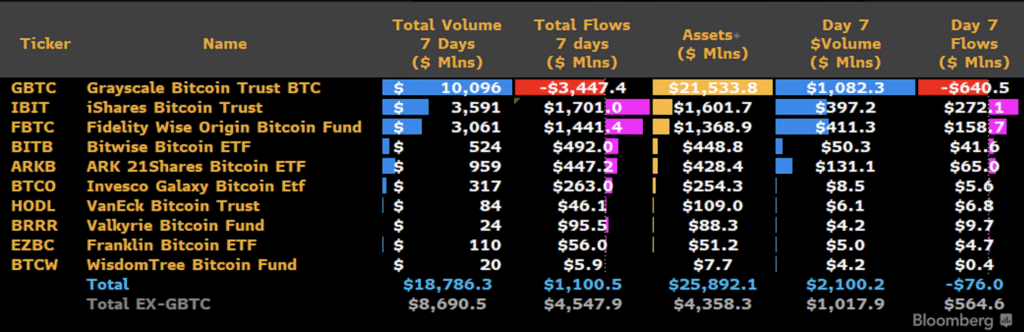

Enough with the schadenfreude… 7 days in the metrics tell a story of one of the most successful launches ever, tempered by significant outflows from Grayscale’s GBTC. Excluding GBTC, volume at $8.6Bn and assets at $4.4Bn over the last week make this the second most traded ETF in the US, just behind IVV (iShares core S&P500). No question this is wildly successful.

Now the caveat… GBTC outflows, a combination of a rather cynical 1.5% management fee (5-7x larger than the new competitors), and a significant amounts of assets riding the GBTC discount trade have catalysed a rush out of this product, $3.5Bn so far, this will need to slow before BTC recovers in price. Grayscale reportedly moved $900m in BTC to Coinbase overnight so we could expect another big day of outflows, rumours are this is linked to the FTX/Alameda administration liquidating their holdings.

On top of this sell pressure miners dumped a further $450m on the market. This sell pressure will ease over the coming days, Grayscale is banking on most GBTC holders to be sitting on large CGT gains they don’t want to realise, as these outflows start to ease BTC will recover.

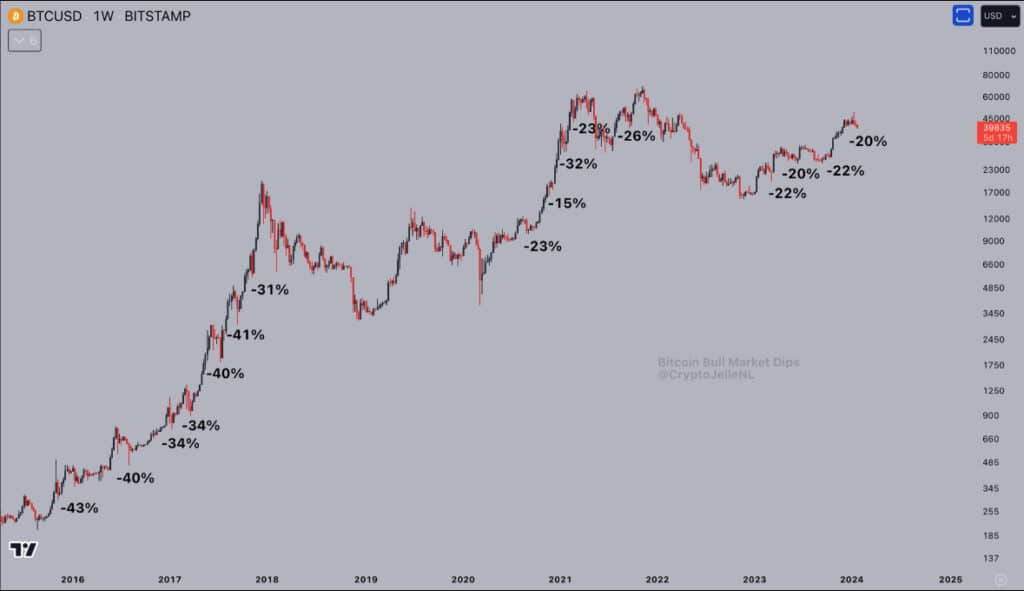

These corrections are normal and healthy for bitcoin and other digital assets in a bull market we expect them every 100 to 150 days they wipe out leverage shake out weak hands and encourage shorts leading to a short squeeze for a push higher.

📈 Chart (table) of the Month

Illustrating the importance of active management timing the move between cash bitcoin and alts is critical to outperforming benchmarks. Overweighting Bitcoin has been the trade of the last 2 years but now as we enter phase 2 of the digital asset market cycle ‘alts’ can massively outperform Bitcoin.

▶️ Podcast of the month

The single most important bitcoin interview of all time? Big call! But worth a listen either way.

Quite interesting to listen to a 2019 macro investor conversation on Bitcoin.

Click here to listen to the Podcast (spotify)

The Merkle Tree Capital “Why?”

We know accessing the digital asset sector is challenging, presenting a new set of risks that most investors are not familiar with, and there is a lot of sub-standard information flying around. That is why we created an actively managed unit trust aiming to hold the best digital assets that will form the basis of the ecosystem over the next 5-10 years.

Investors can now access this new asset class without concerns around self-custody or dealing with unknown counterparties, simplify their tax reporting, avoid single asset risk, maximise yield, and access institutional risk management and portfolio construction.

SMART – actively managed, enhance risk adjusted returns, sophisticated portfolio construction, staking yield, simple exposure – no passwords or digital wallets

SECURE – institutional custody, staking in cold storage, insurance, counterparty due diligence

CRYPTO – Blockchain eliminates intermediaries, lowers costs and improves efficiency by bringing transparency and security.