📢 February Signals

🗓️ Key dates to watch

- Every day – GBTC outflows and net ETF inflows

- 28 February – US GDP Growth rate QoQ 2nd Est.

- 7/8 March – JOLTS/Non farm payrolls

- 12 March – US CPI

⚒️ Fundamentals

- Filecoin Announces Integration With Solana (SOL) for Decentralised Blockchain Storage Solution

- Ether Hits $3K for First Time in Nearly 2 Years Amid Rising ETH ETF Excitement

- UK Minister Expects Stablecoin and Staking Legislation Within Six Months: Bloomberg

- 2 Reasons Bitcoin Could Challenge Record High of $69K Before Halving

- Ethereum Developers Target March 13 for Milestone ‘Dencun’ Upgrade on Mainnet

Get in touch to discuss how digital assets fit in your portfolio:

www.merkle.com.au or [email protected]

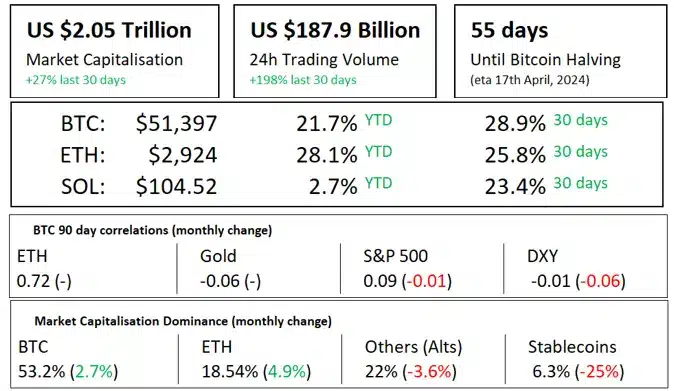

🗒️ Market update

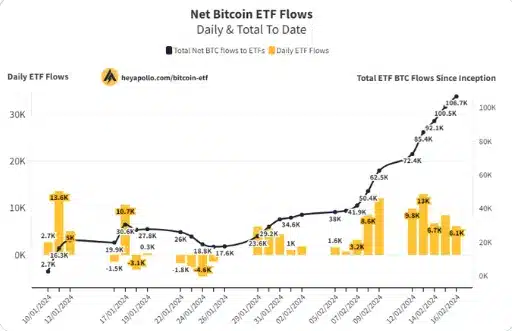

After a muted start the US BTC ETFs are now picking up steam, GBTC outflows initially outpaced the other 9 ETFs inflows but that trend has now reversed, GBTC is seeing some large outflows again as bankrupt lending firm Genesis dumps their holdings but the new ETFs are accumulating BTC even faster. GBTC will have shed about 30% of its BTC in the next few days and we expect flows to slow down to a relative trickle after Genesis is done. Note only 900 BTC are mined everyday, this 1 source of daily demand is regularly 10x supply, about to be 20x after the halving when daily mining supply is cut to 450.

BlackRock, unsurprisingly leads the way with over $6Bn in assets and Fidelity not far behind around $4.5Bn, making them the most successful ETF launches ever (based on 1st month flows). Fidelity have also added bitcoin to their model portfolios in Canada, what was really interesting is we get a benchmark for allocating, 1% to ‘Conservative’ 2.5% to ‘Balanced’ and 3.1% to ‘Aggressive’. We expect Fidelity will soon roll this out to the USA and BlackRock is reportedly about to add their BTC ETF to Aladdin allowing for it to be added to their model portfolios.

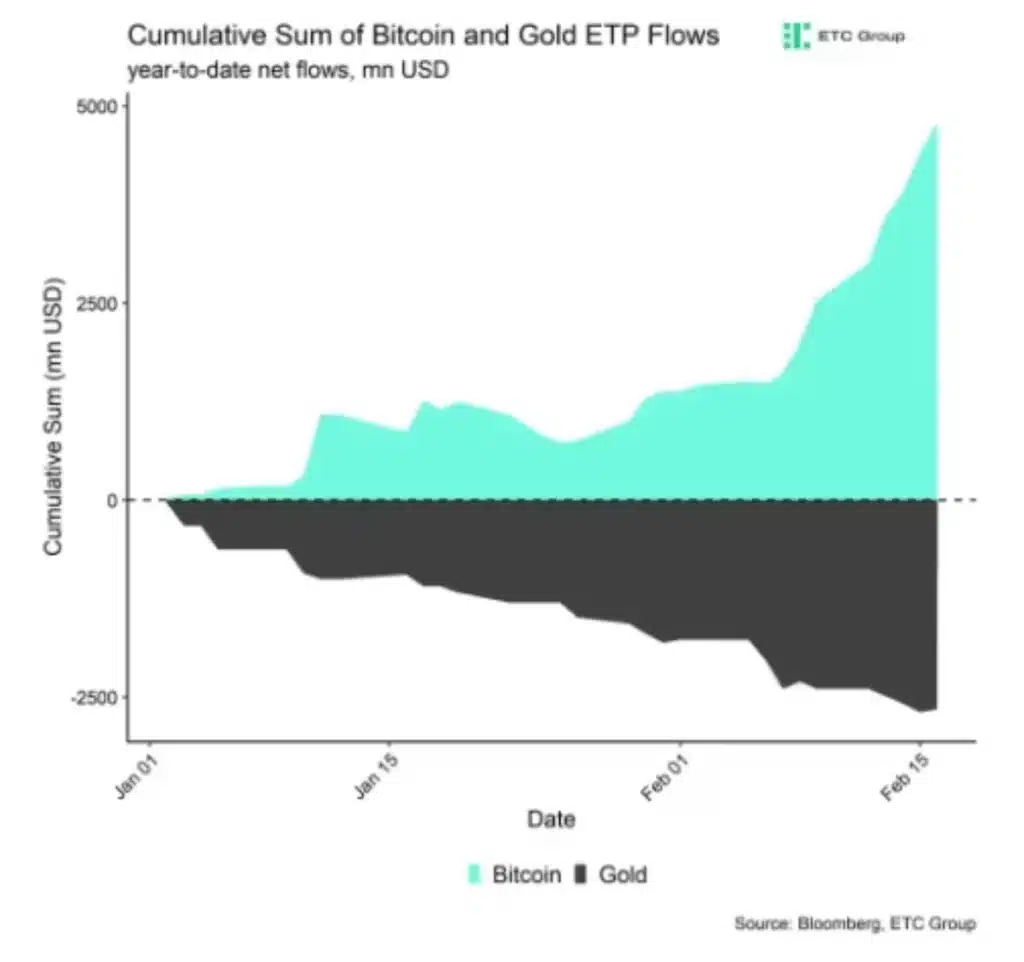

In a bit of a surprise their appears to be a rotation out of Gold ETFs in to BTC ETFs suggesting the ‘digital gold’ narrative is real, although it is hard to imagine BlackRock actively cannibalising one product for another. Still the data is interesting and the correlation looks strong.

Ethereum is finally feeling the love on the back of 2 major catalysts with it next in line for an ETF and a major ‘Dencun’ upgrade on the horizon, the upgrade will support ‘proto-danksharding’ (a much cooler name for the upgrade in my opinion). However the upgrade is more beneficial to layer 2s on the blockchain rather than the base layer and ETF approval is no sure thing, there is a material chance that Gary Gensler would rather deny the application and have the SEC sued in a case they would almost certainly lose (circumstance appear very similar to the BTC case).

DePIN is also having a decent month, more and more investors are waking up to the AI requirement for decentralised data storage and decentralised compute power. If you have seen the latest videos from ‘Sora’ the ChatGPT video content creator then you’ll understand the demand for GPUs are going to go exponential, Render (RNDR) is set to be a major beneficiary of this as is Flliecoin (FIL). Both core holdings of the MTC Digital Asset Fund.

📈 Upcoming webinar!

Upcoming Sharewise webinar featuring Chief Investment Officer and Co-Founder Ryan McMillin. The webinar will feature an interview and live Q&A with the audience, providing you the opportunity to ask Ryan any questions about Merkle Tree that you may have.

Key topics:

- Why is bitcoin and crypto so divisive?

- ETF flows

- What are the portfolio implication of small allocations to digital assets?

- How do you approach portfolio construction in digital assets?

▶️ Podcast of the month

A 30 minute summary of what is generally considered a foundational book on bitcoin, written in 2018 but remains just as relevant today.

A great intro to bitcoin, if you haven’t started your formal bitcoin education this is a great 30 min intro.

Click here to listen to the Podcast (spotify)

The Merkle Tree Capital “Why?”

We know accessing the digital asset sector is challenging, presenting a new set of risks that most investors are not familiar with, and there is a lot of sub-standard information flying around. That is why we created an actively managed unit trust aiming to hold the best digital assets that will form the basis of the ecosystem over the next 5-10 years.

Investors can now access this new asset class without concerns around self-custody or dealing with unknown counterparties, simplify their tax reporting, avoid single asset risk, maximise yield, and access institutional risk management and portfolio construction.

SMART – actively managed, enhance risk adjusted returns, sophisticated portfolio construction, staking yield, simple exposure – no passwords or digital wallets

SECURE – institutional custody, staking in cold storage, insurance, counterparty due diligence

CRYPTO – Blockchain eliminates intermediaries, lowers costs and improves efficiency by bringing transparency and security.