November Signals

Key dates to watch

- 22 November – US Jobless claims (will the uptick continue or stabilise?)

- 13 December – FOMC meeting (a rare 100% probability of another hold)

- 8 December – Non Farm Payroll/unemployment rate

- 12 December – US CPI (forecast slight drop to 3.1%, further fuelling soft landing narrative)

Fundamentals

- Javier Milei Is Now President in Argentina with a pro-Bitcoin agenda

- Fidelity filed a 19b-4 application with the Securities and Exchange Commission late Friday for an Ethereum ETF.

- A pilot program for a live Singapore dollar-based central bank digital currency (CBDC) was unveiled by Singapore’s central bank

- Here’s Why Bitcoin Will 10X from here: Michael Saylor

- HSBC to Initiate Institutional Digital Assets Custody service in 2024

- US seeks more than $4 billion from Binance to end criminal case

Get in touch to discuss how digital assets fit in your portfolio:

www.merkle.com.au or [email protected]

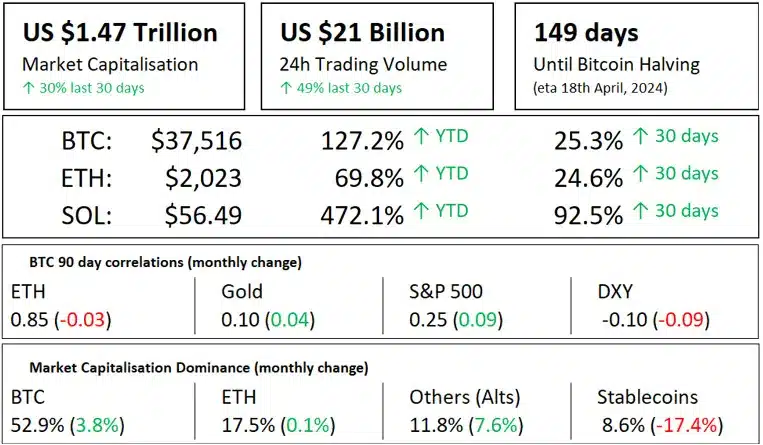

Market update

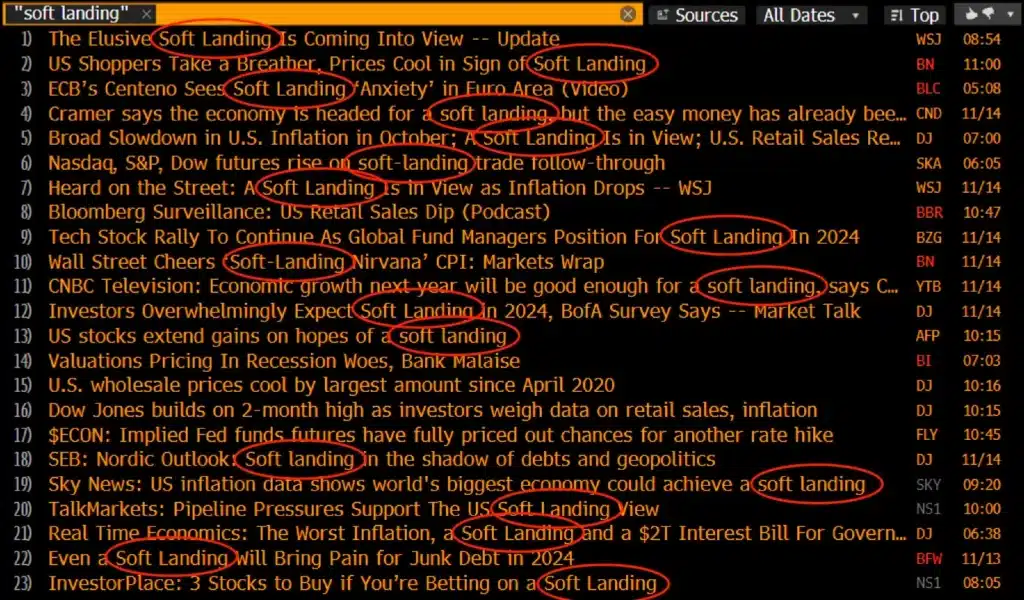

The market rallied hard on soft landing hopes after CPI came in a tick under expectation, US CPI now at 3.2% and Core PCE at 4%. Bond yields dropped and the equity rally that started late October got another boost, interestingly Bitcoin didn’t move on the CPI print. The bond rally may be short lived as reality kicks in that demand for treasuries is actually very low, and the US’s debt situation finally starts to matter (a view recently taken be Stan Druckenmiller being interviewed by Paul Tudor-Jones, pls watch here). The 20 year bond auction this morning held up well, much better than the 30 year auction a couple of weeks ago so this may take a a little longer to play out, particularly while CPI/PCE soften in the short term.

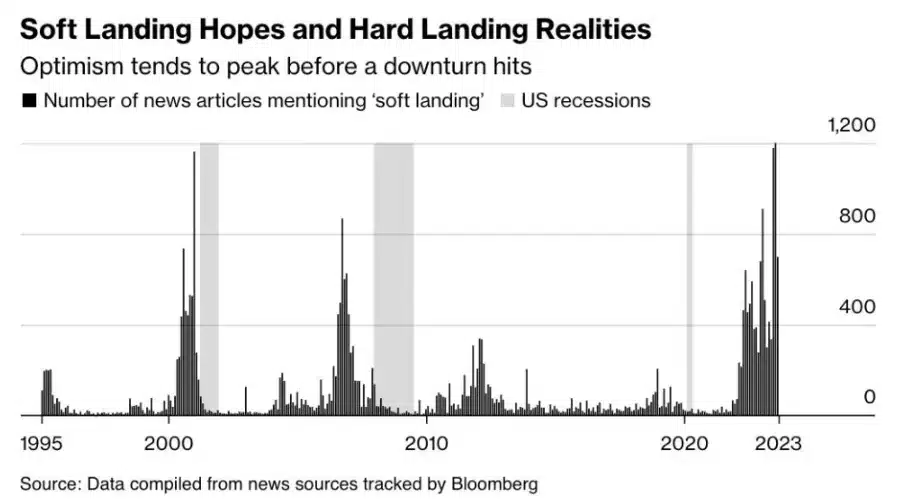

Equities have clearly caught the soft landing narrative and are running with it, the amount of fiscal spending in the US might actually be able to stretch this but jobs are all important a meaningful tick up in jobless claims, unemployment slowly creeping up it does look like classic early recession signs are flashing red, just like the media calling for a soft landing is in itself a red flag.

History tells us a soft landing with debt to GDP over 120% is very unlikely, to save the economy the money printer will be back in action. A great environment for Bitcoin.

Bitcoin barely moved on the inflation data, and is trading on the BlackRock ETF narrative, it now looks like January 10 2024 will be the approval date, which in retrospect should be no surprise the SEC will take every day it can to delay the launch. Bitcoin is also being propelled by the upcoming halving event and is taking much of the ecosystem with it. Typically Alt coins don’t start to outperform BTC until well into the bull market but this month has seen some huge rallies in Alts, Solana up 175% since mid October, AVAX up 87% in November on the back of news JP Morgan is going to use it to tokenise portfolios.

Pro bitcoiner, Javier Milei just won Argentina’s presidency promising a radical shakeup to fix decades of policy mismanagement, a strategy that resonated with a populace suffering under a nosediving economy and one of the world’s fastest inflation rates at 143% p.a.. While he is not on the record for adopting bitcoin as legal tender just yet he does plan to scrap the Peso and the central bank in favour of dollarisation, Peso to USD represents a move towards a harder currency that removes the corruption (mass printing) of the Peso from the Argentine government. If this is successful the next logical step would be to move to or at least open the door to the adopt the hardest currency of all, Bitcoin. Watch this space, we might be seeing the first stages of the global adoption of the bitcoin standard. It makes sense to see adoption start in economies that need it most i.e. those suffering from high or hyperinflation.

Chart of the Month

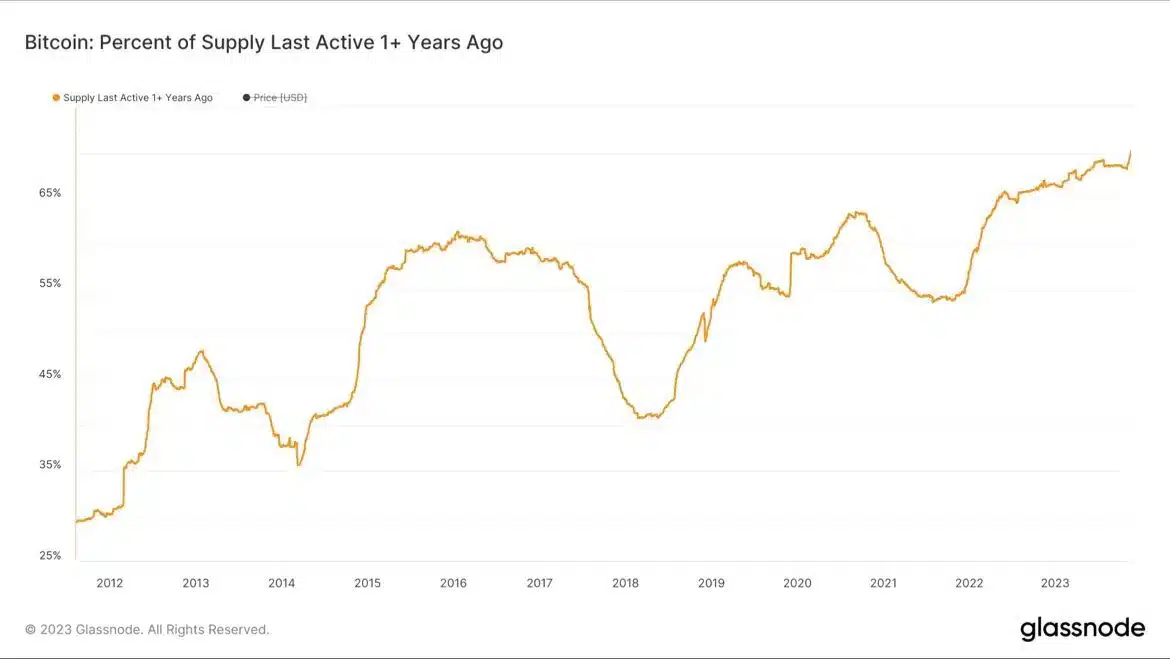

The percentage of Bitcoin supply that hasn’t moved in at least a year just breached 70% for the first time. With the US Spot Bitcoin ETF approval imminent and the Bitcoin halving event only 150 days away, this supply shock along-side a flood of new demand is set to make 2024 a hugely exciting year for digital assets.

Podcast of the month:

James Lavish: Disaster in Bond Market Auction

James Lavish, CFA and former hedge fund manger talks in detail about how poor the recent 30 Year treasury auction was and what is store for next year. Demand for US Gov debt is already in a sorry state and the issuance of debt is about to go through the roof.

I’m no bond expert but I found this to be one of the most educational podcasts I’ve listen to this year.

Click here to listen to the Podcast

The Merkle Tree Capital “Why?”

We know accessing the digital asset sector is challenging, presenting a new set of risks that most investors are not familiar with, and there is a lot of sub-standard information flying around. That is why we created an actively managed unit trust aiming to hold the best digital assets that will form the basis of the ecosystem over the next 5-10 years.

Investors can now access this new asset class without concerns around self-custody or dealing with unknown counterparties, simplify their tax reporting, avoid single asset risk, maximise yield, and access institutional risk management and portfolio construction.

SMART – actively managed, enhance risk adjusted returns, sophisticated portfolio construction, staking yield, simple exposure – no passwords or digital wallets

SECURE – institutional custody, staking in cold storage, insurance, counterparty due diligence

CRYPTO – Blockchain eliminates intermediaries, lowers costs and improves efficiency by bringing transparency and security.