October Signals

Key dates to watch

- 26 October – US Quarterly GDP (coming in hot? est. 4.7%)

- 1 November – FOMC meeting (94% probability of another hold)

- 2/3 November – JOLTs/Non Farm Payroll

- 14 November – US CPI (more sideways chop)

Fundamentals

- SEC Won’t Appeal Loss in Grayscale Case, Boosting the Odds GBTC Can Become a Bitcoin ETF

- Australia Proposes New Licensing Regime for Crypto Exchanges, Aims for Draft Legislation by 2024

- Deutsche Bank to provide custody services for institutional clients’ cryptocurrencies

- JPMorgan Debuts Blockchain Collateral Settlement in BlackRock-Barclays Trade

- Ferrari to Start Accepting Crypto Payments in U.S, Europe to Follow

- Spot Bitcoin ETF Approvals Could Add $1 Trillion to Crypto Market Cap, CryptoQuant Says

Get in touch to discuss how digital assets fit in your portfolio:

www.merkle.com.au or [email protected]

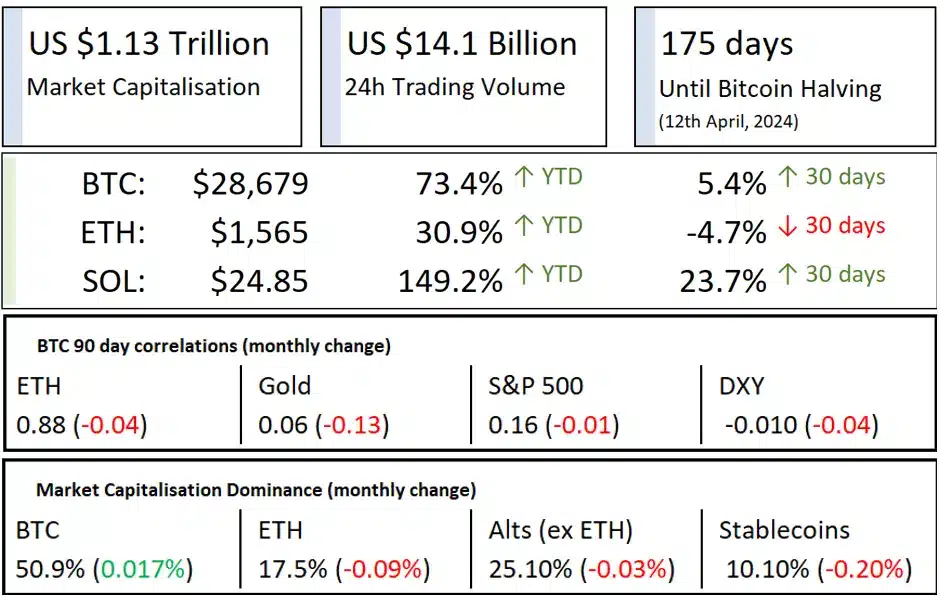

Market update

The last month was a volatile one for markets, rising yields, inflation uncertainty, and geopolitical tensions all weighing on sentiment. Higher for longer is setting in, the bond market has adjusted, or is testing the viability of the narrative, equities haven’t repriced (enough) so something will have to give.

Rising Yields

One of the biggest stories of the month was the sharp rise in yields across the globe. This was driven by a number of factors, including expectations of further tightening by central banks, strong economic data, and concerns about inflation.

The rise in yields has had a significant impact on markets, with bond prices falling and risk assets coming under pressure. It has also made it more expensive for companies to borrow money, which could weigh on earnings growth.

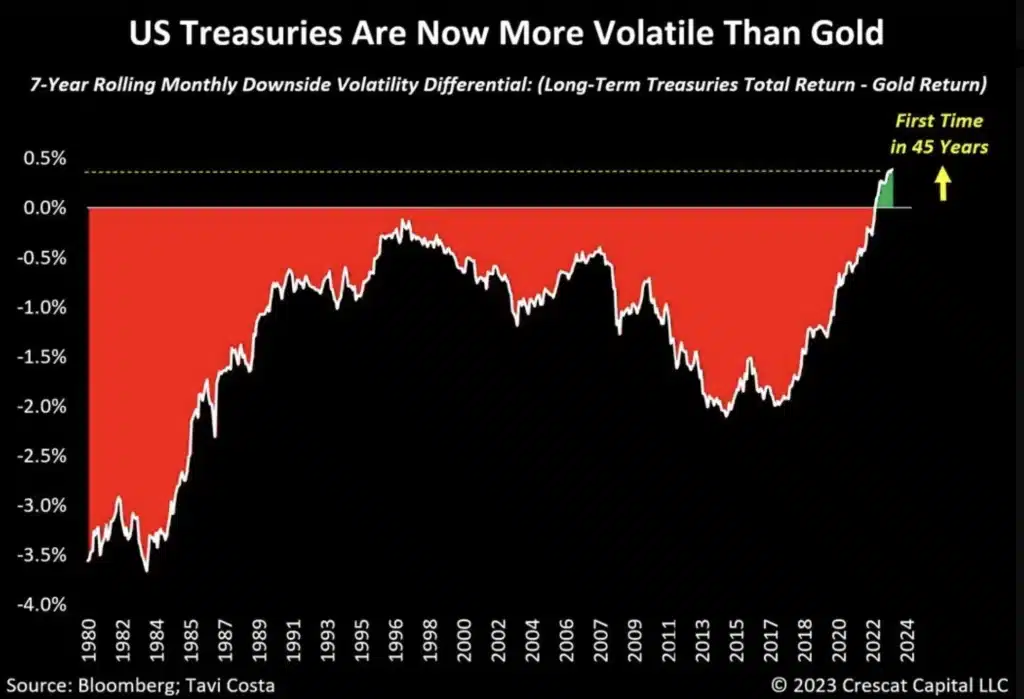

Risky Risk-Free

Traditionally, investors have turned to government bonds as a safe haven in times of turmoil. However, with yields rising sharply, government bonds are no longer risk-free. Bond prices move inversely to yields, as yields rise, bond prices fall. This means that investors who bought long-term government bonds only a couple of years age will lose money if they sell them before they mature, and while they receive the same amount back on maturity inflation will ensure that amount no longer has the same purchasing power.

Long duration US treasuries as measured by TLT (popular ETF for accessing 20+ year treasuries) often touted as ‘risk free’, are now down 53% since early 2020, that is a greater drawdown than equities over the 2008 GFC.

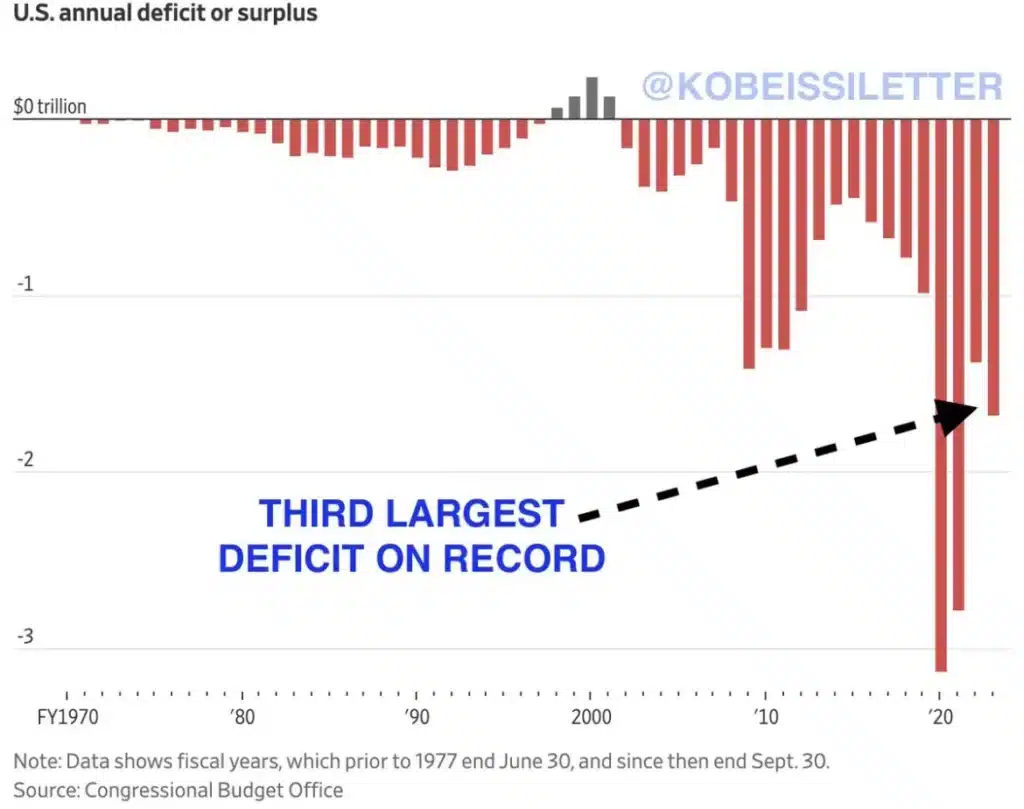

Our view is this is the market questioning the US government ability to repay its $33.6trn debt pile, at 124% of GDP this is worth questioning, add to this a further c$200Trn in unfunded future promises (future welfare payments) the moniker ‘risk free’ doesn’t sit very well with me either.

Deficit spending is at its third highest on record and we are not even in a recession, this is not sustainable, however it is also very difficult to imagine any form of austerity or significant rise in tax revenue. Some form of money printing will be required, it will likely have a nice new euphemistic name, but the result will be the same debasement of fiat currency and its purchasing power.

Hedge fund legend Paul Tudor Jones said earlier this month that the combination of extensive geopolitical risk and rising U.S. government debt levels make it difficult to own stocks, but that bitcoin (BTC) and gold are attractive options.

“As interest costs go up in the United States,” said Jones, “you get in this vicious circle, where higher interest rates cause higher funding costs, cause higher debt issuance, which cause further bond liquidation, which cause higher rates, which put us in an untenable fiscal position.”

Bitcoin Sitting Outside the System

Bitcoin has been one of the few asset classes to perform well in recent months, despite the volatility in other markets. This is likely because Bitcoin is seen as a hedge against inflation and a safe haven from traditional financial markets.

Bitcoin is also attractive to investors because it is outside the traditional financial system. This means that it is not subject to the same risks as other assets, such as government bonds and equities.

Bitcoin’s Gold-Like Features

Bitcoin is often compared to gold because of its scarcity and its ability to store value. Bitcoin has a fixed supply of 21 million coins, and its production is gradually reduced over time. This makes Bitcoin scarce, which is one of the key drivers of its value.

Bitcoin is also a good store of value because it is not subject to inflation. Unlike fiat currencies, Bitcoin cannot be created or ‘printed’ by central banks. This means that Bitcoin is less likely to lose its value over time.

In addition to its scarcity and its ability to store value, Bitcoin also has a number of other advantages over gold. For example, Bitcoin is more portable and divisible than gold. Bitcoin can also be easily transferred over the internet.

Overall, Bitcoin’s gold-like features make it a solid investment for investors who are looking for an asset that is scarce, can store value, and is outside the traditional financial system.

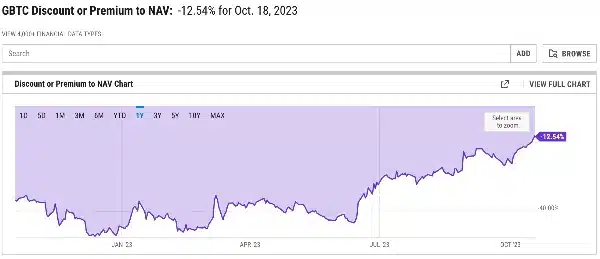

Chart of the Month

The closing of the Grayscale Bitcoin Trust (GBTC) discount is an excellent inverse proxy for the probability of a spot Bitcoin ETF being approved. This is because GBTC is currently the only way to invest in Bitcoin through a traditional brokerage account. If a spot Bitcoin ETF is approved, it would provide investors with a much easier and more efficient way to invest in Bitcoin. This would likely lead to a significant increase in demand for Bitcoin, which would push up the price of Bitcoin and close the GBTC discount close to 0%.

Bitcoin Spot ETF 90% Shot at Approval in January 2024

Bloomberg analysts Eric Balchunas and James Seyffart predicted in a note recently that a spot Bitcoin exchange-traded fund (ETF) has a 90% chance of approval by January 2024. The analysts cited recent updates to the spot Bitcoin ETF prospectus filed by Ark Invest and 21Shares as signalling constructive engagement with the Securities and Exchange Commission (SEC) – a typical precursor to regulatory approval.

The additional disclosures and context provided in Ark and 21Shares’ revised prospectus spanned at least five pages, indicating the SEC had requested more information on the proposed spot Bitcoin ETF.

According to analysts, this back-and-forth between the sponsors and regulators represents a return to normal procedures and bodes well for eventual approval.

As a disclosure-focused regulator, the SEC is expected to ensure risks are properly outlined without judging the merits of the investment itself. The recent prospectus revisions suggest the SEC is adhering to this role in assessing the Bitcoin ETF.

The Bloomberg analysts’ optimistic prediction comes despite years of high-profile rejections for spot Bitcoin ETFs. But Balchunas and Seyffart expect improved crypto market oversight and declining volatility to sway the SEC within months.

Podcast of the month:

How the Federal Reserve works

A great time to revisit one of the most important institutions in the fiat money system. We might think the Fed is of little consequence to us here in Australia but as the operator of the world’s primary reserve currency it is an institution that impacts every investment made all around the world be controlling the overnight ‘risk free’ rate.

Joseph Wang is a former senior treasury trader for the Fed and well worth listening too.

Click here to listen to the Podcast

The Merkle Tree Capital “Why?”

We know accessing the digital asset sector is challenging, presenting a new set of risks that most investors are not familiar with, and there is a lot of sub-standard information flying around. That is why we created an actively managed unit trust aiming to hold the best digital assets that will form the basis of the ecosystem over the next 5-10 years.

Investors can now access this new asset class without concerns around self-custody or dealing with unknown counterparties, simplify their tax reporting, avoid single asset risk, maximise yield, and access institutional risk management and portfolio construction.

SMART – actively managed, enhance risk adjusted returns, sophisticated portfolio construction, staking yield, simple exposure – no passwords or digital wallets

SECURE – institutional custody, staking in cold storage, insurance, counterparty due diligence

CRYPTO – Blockchain eliminates intermediaries, lowers costs and improves efficiency by bringing transparency and security.