September Signals

Key dates to watch

- 21 September – FOMC meeting (99% probability of a pause)

- 28 September – US GDP growth rate (forecast 2.1%)

- 29 September – Core PCE (forecast 0.2%)

- 29/30 September – China Manufacturing PMIs

- 4/6 October – Job Openings / Non Farm Payrolls (18 months of downward revisions)

- 14 October – The 45 day deadline for the SEC to appeal it’s District Court loss in denying GBTC ETF conversion

- 16/17 October – 2nd SEC deadline for multiple BTC and ETH ETF (decent probability the SEC capitulates and approves most applications)

Fundamentals

- Visa promises faster credit card payments with USDC on Solana

- Australian Cardiac Institute ditches cloud storage in favour of Filecoin

- Deutsche Bank to hold crypto for institutional clients

- Change to US accounting rules will be a boon to companies holding crypto in 2025

- A year after the Ethereum Merge, net supply down nearly 300K Ether

Get in touch to discuss how digital assets fit in your portfolio:

www.merkle.com.au or [email protected]

Market update

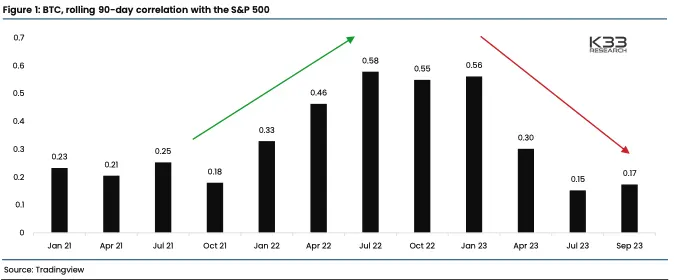

Throughout 2023, crypto-specific headlines and liquidity events have dictated the market direction. Short squeezes, ETF headlines, and sell-side pressure from bankruptcy estates and the U.S. government have been the most decisive market-moving forces. Bitcoin’s 90- day correlation to the S&P 500 and the DXY (US Dollar Index) sits at 0.17 and -0.14, respectively – a major change from the start of the year when correlations to the same indices sat at 0.56 and -0.46.

This suggests macro is starting to have less impact on digital assets, the spot BTC ETF is still the number 1 catalyst the market is watching, a mid October approval is a real possibility, this aligns the 45 day deadline for the SEC to comment on the GBTC court case conversion and the 2nd SEC deadline for comment on a host of other applications including BlackRock’s. This is D Day for the SEC, they can either accept they have lost this fight or they will need to persecute the case (to not allow BTC spot ETFs) on new grounds, given they have had 10 years since the first BTC ETF application (from the Winklevoss twins) and the best argument they managed has now been deemed capricious and arbitrary I doubt they can find a better argument in just 45 days.

Sentiment has turned positive as many indicators now suggest a slight bullish outlook among active derivatives traders on CME, marking a shift from the bearish sentiment observed since mid-August. The last week saw a 19% growth in open interest from active market participants, with futures premiums climbing from 4.8% to 8.4% following burgeoning activity in the October contract.

Macro does still matter and the FOMC is likely to extend its pause tomorrow with 99% market expectation, and some hawkish commentary thrown in for good measure. Annualised headline CPI has ticked up to 3.7% over the last couple of months while the Feds preferred measure, Core, has continued falling, now down to 4.3%. Oil was up as much as 37% from its late June lows which will feed in to CPI over the next few months, but it may have just hit resistance around the $92 barrel mark, Saudis are trying to pump the price so they can IPO Aramco but the futures market is now in backwardation (spot price is higher than futures price) suggesting the rally might be just about done.

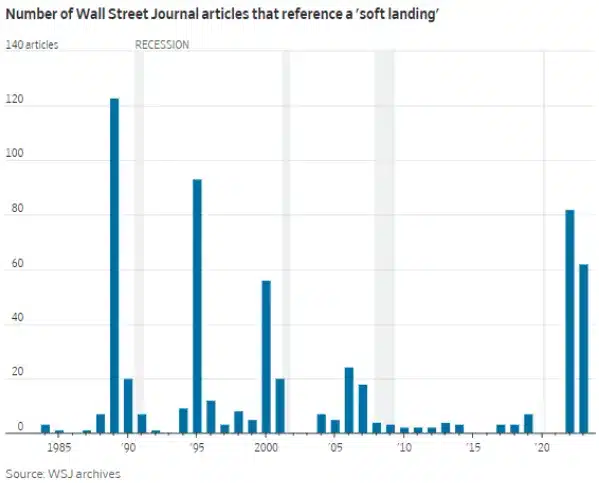

Recent history tells us that recessions don’t happen until most punters are convinced a soft landing is more likely than not, only then can we have a recession (grey lines indicate recession).

The MTC Digital Asset Fund turns 2!

We are extremely excited to share that the MTC Digital Asset Fund has recently turned 2! 🎉 Since launching the fund in August 2021 we have experienced a very turbulent period in the markets including one of the most challenging years ever for risk-on assets. Through tough periods and when our backs are against the wall, we truly believe that the most valuable lessons are learnt. In this piece, Dean Serroni, Co-Founder and CEO of Merkle Tree Capital reflects on his top 3 learnings.

Chart of the Month

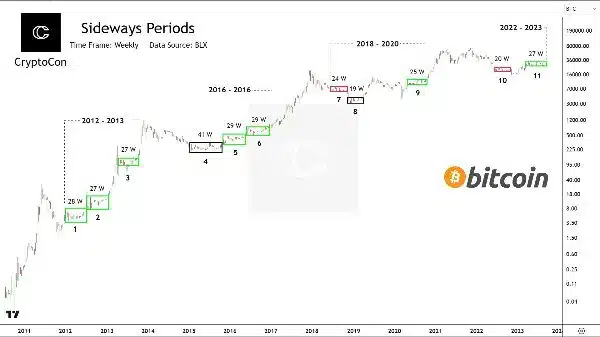

Bitcoin is on its 27th week of sideways price action. The average sideways period is 27 weeks (slightly over 6 months) and of the 11 sideways periods 9 have ended in price break above the sideways range.

Insight: Debt and Inflation

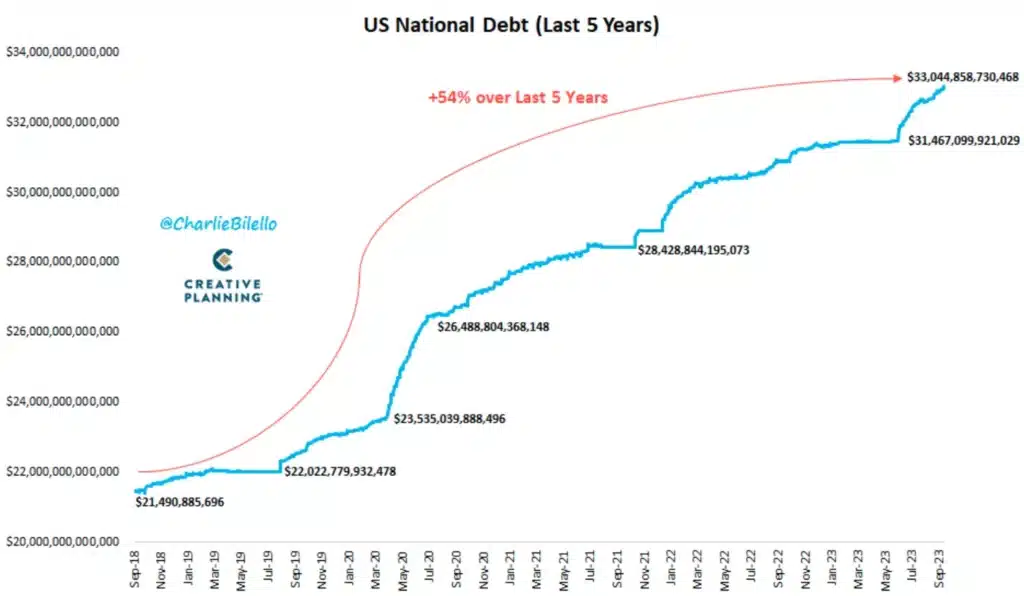

US national debt surpassed $33 Trillion that’s $33,000,000,000,000.00 for the first time this week, debt is rising at it fastest pace ever, even in real terms. Since the debt ceiling was resolved (i.e. suspended rather than lifted meaning spending is now completely unrestricted) debts has been rising at $33Bn a day, $3Bn of which is interest expense on existing debt. At the current rate of $1Trn in additional debt every month it will hit $50Trn by Jan 2025 the next date the ceiling will be agreed, this is nearly 10 years earlier than was predicted earlier this year! Can you imagine what happens if the US enters recession!

This should give everyone pause for thought, what is the plan? One thing is for sure it will involve a lot on money printing/debasement, when Larry Fink, BlackRock CEO, recently said that Bitcoin is going to transcend any one currency in valuation and that it is an international asset, what he means is investors can hold it to protect themselves from the devaluation that is happening in government issued currencies (we see this via inflation).

Inflation has always been and will always be a monetary phenomenon, when new money enters the system and chases the same amount of goods and services the price of those goods and services go up. When the Spanish found the worlds largest silver deposit in Peru Potsi in 1545 Europe was soon flooded with new currency causing the ‘Great Inflation’. Covid saw something in the order of a 40% increase in money supply so we should expect to see the inflation we have be of a similar magnitude. While central banks around the world try to decrease monetary supply most governments are offsetting this with reckless fiscal spending.

Under this scenario Bitcoin and some other crypto assets, but particularly Bitcoin, will become a risk off asset, similar to gold, but on an exponential adoption curve and an asset which is much faster and cheaper to transact in, easier to self custody and transport, more divisible and completely verifiable, e.g. how much gold is in Fort Knox or held by the PBOC? Know one knows for certain as is hasn’t been independently verified, BTC on the other hand is visible to everyone, we know with absolute certainty that the US government hold 175,000 Bitcoin, and we know every time they move any of it.

Podcast of the month:

How Bitcoin Fixes Money with Lyn Alden

Lyn Alden is a macroeconomist and investment strategist. This interview is the final of three shows where we discuss Lyn’s amazing new book: Broken Money. In this show, we recap the flaws in the modern financial system, and then we discuss the potential of Bitcoin as a decentralised solution with its ability to allow hard asset money to move globally at speed.

I also highly recommend her new Book (although am only a few chapters in) Broken Money.

Click here to listen to the Podcast

The Merkle Tree Capital “Why?”

We know accessing the digital asset sector is challenging, presenting a new set of risks that most investors are not familiar with, and there is a lot of sub-standard information flying around. That is why we created an actively managed unit trust aiming to hold the best digital assets that will form the basis of the ecosystem over the next 5-10 years.

Investors can now access this new asset class without concerns around self-custody or dealing with unknown counterparties, simplify their tax reporting, avoid single asset risk, maximise yield, and access institutional risk management and portfolio construction.

SMART – actively managed, enhance risk adjusted returns, sophisticated portfolio construction, staking yield, simple exposure – no passwords or digital wallets

SECURE – institutional custody, staking in cold storage, insurance, counterparty due diligence

CRYPTO – Blockchain eliminates intermediaries, lowers costs and improves efficiency by bringing transparency and security.