August Signals

Key dates to watch

- 24-25 August – Jackson Hole Symposium )

- 1 September – Non-Farm Payrolls & 1st deadline for SEC comment on BlackRock Spot BTC ETF application

- 9 September – China Inflation (-0.4% forecast)

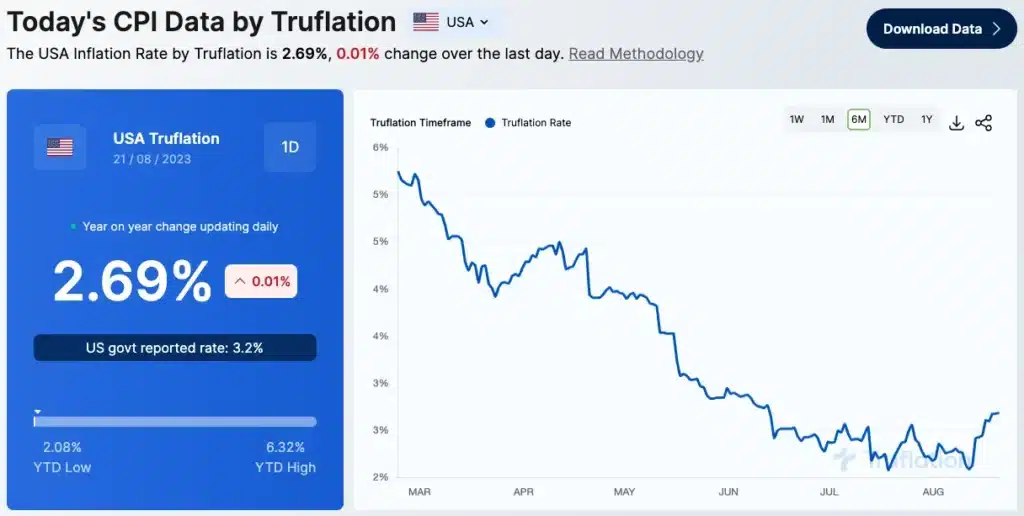

- 13 September – US Inflation (have we bottomed around 3%?)

- 14 September– Producer Price Inflation (leading CPI indicator)

- 20 September – FOMC meeting (90% probability of a pause)

Fundamentals

- PayPal launches stablecoin Tied to the US Dollar, Issued on Ethereum

- Ether Futures ETFs Could All Get Approval At Same Time

- Cathie Wood: SEC to Approve Multiple Bitcoin ETFs Simultaneously

- FTX Founder Sam Bankman-Fried Pleads for a Weekday Release Ahead of October Fraud trial

- Jacobi Asset Management Introduces Europe’s First Premier Bitcoin ETF with a Green Initiative

- Polygon Expanded Collaborations with Disney, Meta, Starbucks, and More in Q2 2023

Market update

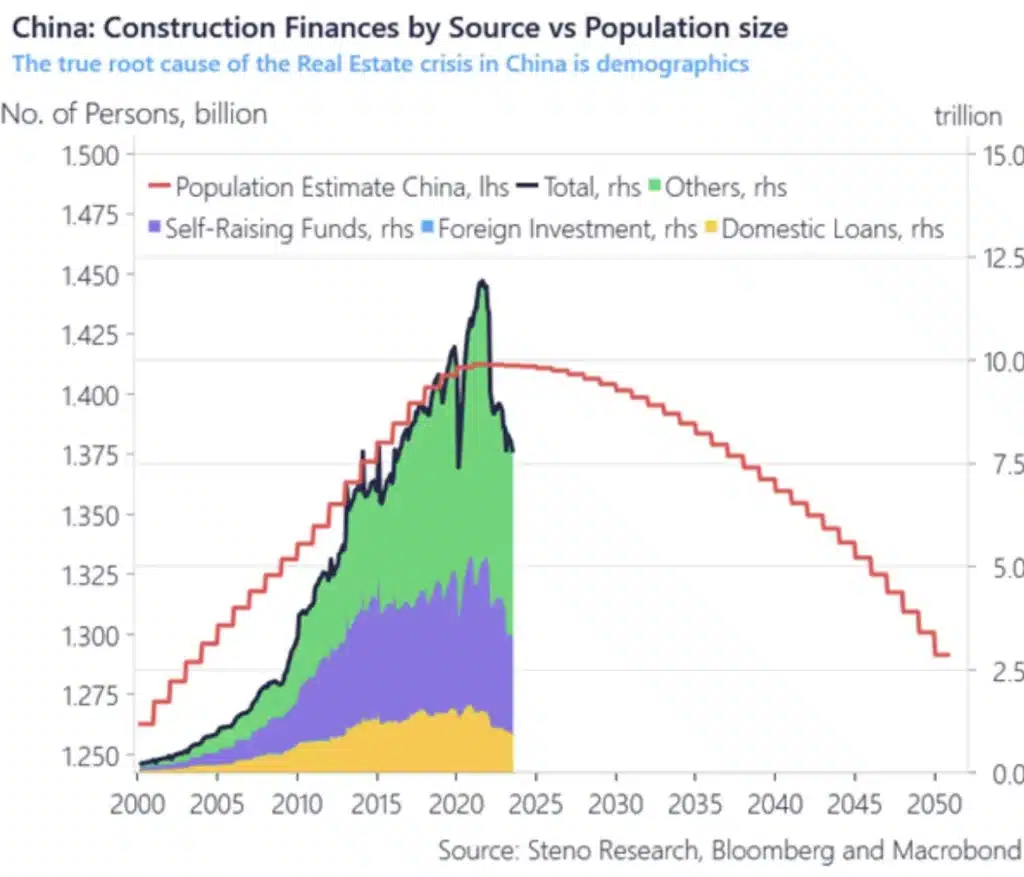

The China reopening story continues to disappoint, GDP growth disappointed as export fell 14.5% and imports fell 12.5%, and deflation kicked in and looks set to continue, prices down -0.3% and forecast -0.4% next month. Country Garden is facing a default suffering large losses and $200bn in unpaid bills, this was recently the largest property developer in China and joins Evergrande in serious trouble, Evergrade filled for chapter 15 bankruptcy in the States buying time to restructure and hold its US assets. It’s always hard to get a real read on data coming out of china, there are reports of 50 million empty homes and vacancy rates over 20%, and undelivered developments in trillions of sqm. Chinese real estate market at $55Trn is the biggest asset class in the world, bigger than the US equities market at $46Trn, and it is looking increasing shaky. To further pressure the situation reported youth unemployment hit a record high at 21.3% (and will no longer be reported until the data is ‘optimised’). Overlay the demographic situation and things look even worse (see below). China needs to hit the stimulus button, one benefit of a single party system is there will be no opposition, as such it could come very quickly, while it will re-inflate the property bubble, that is much better than the alternative.

Truflation, a forward looking indictor is showing signs of bouncing, shelter inflation and China’s deflation will put downwards pressure on CPI in the coming months, will this be enough to offset the rebound in energy? Maybe not in the next set of figures but all else being equal from here there is scope to head lower. Oil has been pushed higher on Saudi production cuts, a 2m barrel cut down to 9m barrels a day, further cuts are unlikely as they will only serve to hurt the Saudi’s market share

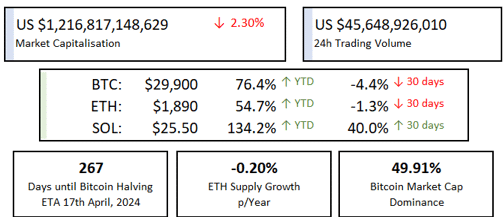

Bitcoin continued its prolonged low-volatility trading range between $29,000 and $30,000. However, a noticeable shift began on Wednesday, followed by accelerated momentum on Thursday. The initial dip halted at around $28,500, but the story didn’t end there. On Thursday, the price took a substantial plunge, touching $25,000 before rebounding to its current level of $26,500.

Space X reportedly wrote down the value of its bitcoin by $373m and the Evergrande bankruptcy filing landed just before the big red candle, while this served as the catalyst for the sell off the market structure exacerbated the move. The build-up of leverage (open interest in the derivatives market) created the perfect conditions for rapid feedback loops, as evidenced by the sizeable amount of liquidation and subsequent drop in open interest. As a result, there is no reason this drop should lead to a continued negative trend. If anything, the wipeout of longs and increased shorting may lay the foundations for an upcoming short squeeze.

Shortly after prices crashed on Thursday, rumours of the SEC green lighting an Ether futures ETF in the U.S. started circulating. The positive news led to a sharper rebound in Ether than other cryptos.

In the Spot BTC ETF race the ARK 2nd deadline came and went, a BAU deadline in the GBTC conversion came and went, and now we wait for a 1st deadline comment on the BlackRock et al filings on 1 September. Grayscale (GBTC ETF conversion) could drop anytime, each Tuesday and Friday now represent a chance for a court decision, there was a lot of noise around a 18 August as a high probability date but now with that passed, we think October lines up better with historical commentary expecting a Q4 decision and potentially a mass approval of all outstanding applications.

Chart of the Month

The April 2024 halving will be the first halving where the supply of BTC available for trade has decreased since the previous halving.

Insights: Bitcoin and ESG: A Report by KPMGt Against the SEC

There has been a lot of misinformation and fear mongering on this topic, Bitcoiners know its ESG credentials are very sound, but mainstream has predominately stuck with the tired biased narrative to the contrary. This KPMG report starts to set the record straight and is a must read for anyone interested in ESG investing and digital assets. Click here for more information and a link to the KPMG report.

Podcast of the month:

Marco Sunday: 3 scenarios for the Chinese response to the RE malaise

Steno Research host Michael Kao to discuss teh Chinese response to the RE crisis, the 7.30 yuan to dollar and other macro issues of the week.

Click here to listen to the Podcast

The Merkle Tree Capital “Why?”

We know accessing the digital asset sector is challenging, presenting a new set of risks that most investors are not familiar with, and there is a lot of sub-standard information flying around. That is why we created an actively managed unit trust aiming to hold the best digital assets that will form the basis of the ecosystem over the next 5-10 years.

Investors can now access this new asset class without concerns around self-custody or dealing with unknown counterparties, simplify their tax reporting, avoid single asset risk, maximise yield, and access institutional risk management and portfolio construction.

SMART – actively managed, enhance risk adjusted returns, sophisticated portfolio construction, staking yield, simple exposure – no passwords or digital wallets

SECURE – institutional custody, staking in cold storage, insurance, counterparty due diligence

CRYPTO – Blockchain eliminates intermediaries, lowers costs and improves efficiency by bringing transparency and security.