July Signals

Key dates to watch

- 26 July – FOMC meeting (A 0.25 raise is all but locked in so commentary will be more interesting)

- 2/4 August – JOLTs job openings / Non Farm Payrolls

- 10 August – US CPI (headline now at 2.97%, can it continue falling?)

- 11 August – Producer Price Inflation (leading CPI indicator, currently 0.1% and trending lower)

- 13 August – SEC second deadline for comment on ARK Spot BTC ETF application

Fundamentals

- Google Play changes policy toward blockchain-based apps, opening door to tokenized digital assets, NFTs

- ETF Filings Could Introduce Bitcoin to a $30 trillionllion market

- BTC Supply on Exchanges drops to 5-year low amid SEC-Induced Panic

- Ripple, Crypto Industry Score partial win in SEC court fight over XRP

- Crypto investment products see largest weekly inflow since July 2022

- Bitcoin to $1.5 Million? Cathie Wood says her confidence has increased

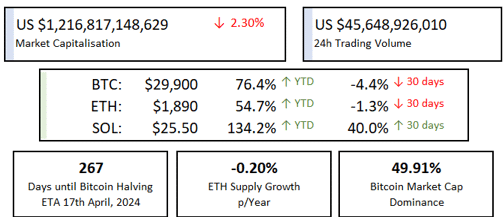

Market update

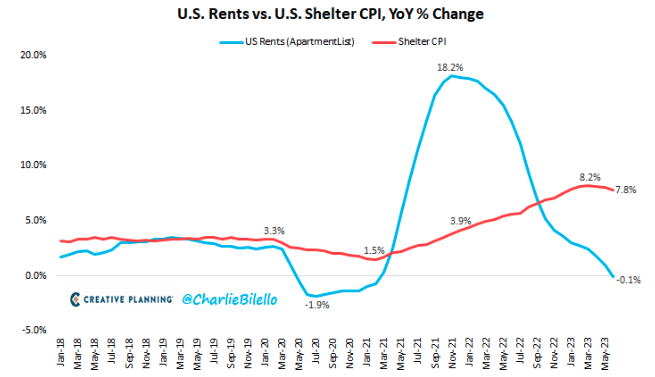

Headline inflation in the US dropped to 2.97% earlier in the month, and while we have experienced the last of the large base effect moves we do expect the lagging shelter component to continue pushing CPI down to target later this year (see chart below). Truflation, the real time inflation calculator, calculates the current rate at 2.13% using more real time data than the Federal Reserve methodology. The FOMC probably shouldn’t raise rates again this week (let’s not forget less than two years ago CPI was 5% and rising, it was ‘transitory’ and rates could be kept at 0.10% now CPI is 2.97% and falling but 5.25% is not restrictive enough?), however Powell seems to have painted himself into a corner, calling for at least 2 more cuts this year, and market odds are now 98.3% in favour of a 0.25% raise next week.

Recession risks persist and China is not providing the counter cyclical boost we’re used to, China’s ‘reopening’ has disappointed, stimulus has come in more cap gun than bazooka form as local government and real estate debt weigh on their economy. US corporates are in decent shape, Q2 earnings are holding up, and they seem reluctant to fire after having so much difficulty hiring post COVID, with inflation dropping a soft landing does look possible and priced in to equity markets, NDQ up 49% YTD.

30 yr fixed mortgages are standard in the US and are driving a house building boom (secondary sales are weak as most home owners have a 30yr mortgage locked in at 3%, selling and buying new would need them to refinance at 6-7%) new builds are great for the economy, jobs, supplies etc all multiples better for economic growth than secondary sales. Pockets of strength like this are raising hopes soft landing is possible, if inflation behaves FOMC could be easing before ‘something breaks’.

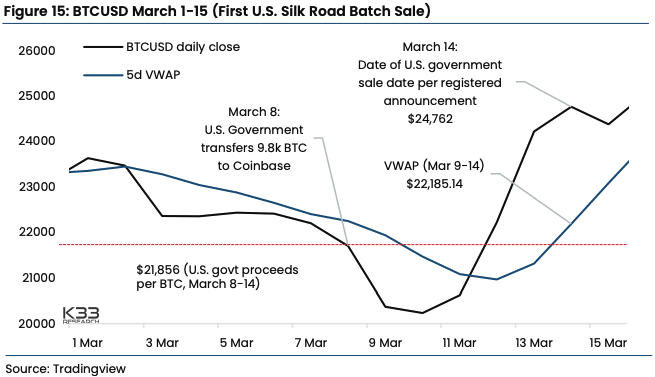

With equities rallying and bond yields dropping we could expect BTC and other digital assets to be rallying hard, a BlackRock ETF seems inevitable, Larry Fink has been touring the live news circuit calling bitcoin ‘digitised gold’ and crypto an ‘international asset’ that will ‘transcend’ government issued currencies, XRP had a major win against the SEC where the court stated it is in of itself is not a security. But BTC remains range bound, consolidating around US$30,000. We believe this is could be due to US government moving 8,200 BTC to a series of addresses (all holding 79 BTC) in preparation to sell down their second tranche of Silk Road confiscated BTC, of which they now have 41,500 after selling 9,800 in early March. This sell pressure has likely been happening all week and kept BTC from breaking out of its current range. The sale of the first tranche clearly occurred before it was announced.

The XRP case ruling by U.S. District Judge Analisa Torres was the first win for a cryptocurrency company in a case brought by the U.S. Securities and Exchange Commission — though it did also give the SEC a partial victory. Ripple Chief Executive Brad Garlinghouse in an interview called the ruling “a huge win for Ripple but more importantly for the industry overall in the U.S.”

Coinbase, the largest U.S. crypto exchange, said it would again allow trading of XRP on its platform. “We’ve read Judge Torres’ thoughtful decision. We’ve carefully reviewed our analysis. It’s time to relist,” Coinbase chief legal officer Paul Grewal said on Twitter. More on this below.

Insights: Ripple’s win against the SEC

One of crypto’s biggest debates — what should and shouldn’t count as a security in the eyes of US regulators — turned promising for retail-facing projects after a key legal ruling last Friday. But like many things in the legal arena, the decision wasn’t completely clear-cut.

A three-year court battle between Ripple Labs, the developer of the Ripple blockchain, and the Securities and Exchange Commission took a major turn, with a federal judge ruling that the network’s XRP token was a security when Ripple sold it to institutional investors a number of years ago — but not to the general public.

Notably, Judge Torres held that “XRP, as a digital token, is not in and of itself a ‘contract, transaction, or scheme’ that embodies the Howey requirements of an investment contract,” but “ordinary asset—like gold, silver, and sugar—may be sold as investment contracts, depending on the circumstances of those sales.”

What is the read across for other Alt coins and other SEC enforcement such as the Coinbase case?

“For exchanges, for tokens that are listed on exchanges, for regular investors, there’s no question that this ruling strikes a blow to the idea that somehow securities are being traded when people go onto exchanges and trade the assets,” Paul Grewal, chief legal officer at Coinbase, told CNBC in a TV interview on Friday.

“I think we will win. Now, I thought we would win before this decision. We think this decision has only further strengthened the case,” he added.

Podcast (book) of the month:

The Price of Time \ Edward Chancellor & Joseph Wang

Great timing for this podcast, having just finished Edward Chancellor’s book ‘The Price of Time’, this podcast was published. I can’t recommend the book more highly, and hope this podcast piques your interest to pick it up. While mildly skeptical of ‘crypto’ Edward certainly knows his onions as they pertain to the history of monetary policy and inflation. Highly critical of interest rates being held below their natural rate he unpacks historical examples of boom and bust in a highly entertaining manor. Also critical of Keynesian economics, favouring Austrian economics, and I fully agree with his take that central banks today rather than reduce the boom and bust extremes they exacerbate them, I’m sure he is a Bitcoiner that just hasn’t been orange pilled yet (a ‘precoiner’).

Click here to listen to the Podcast

The Merkle Tree Capital “Why?”

We know accessing the digital asset sector is challenging, presenting a new set of risks that most investors are not familiar with, and there is a lot of sub-standard information flying around. That is why we created an actively managed unit trust aiming to hold the best digital assets that will form the basis of the ecosystem over the next 5-10 years.

Investors can now access this new asset class without concerns around self-custody or dealing with unknown counterparties, simplify their tax reporting, avoid single asset risk, maximise yield, and access institutional risk management and portfolio construction.

SMART – actively managed, enhance risk adjusted returns, sophisticated portfolio construction, staking yield, simple exposure – no passwords or digital wallets

SECURE – institutional custody, staking in cold storage, insurance, counterparty due diligence

CRYPTO – Blockchain eliminates intermediaries, lowers costs and improves efficiency by bringing transparency and security.