June Signals

- BlackRock applies for a spot Bitcoin ETF, do they know something we don’t know? In 45 days we’ll see a response from the SEC.

- Regulatory clarity incoming! Silver lining on SEC action against Coinbase, the courts may have the final say on whether or not common crypto assets are securities.

- EDX Markets launches, a new crypto exchange created by Citadel, Fidelity & Charles Schwab. Not only backed by TradFi but a very TradFi business model (non-custodial) this segregation of duties will be welcomed by the SEC.

Key dates to watch

- 30 June – Core PCE price index (the Fed’s preferred inflation metric)

- 7 July – JOLTs job openings / Non Farm Payrolls

- 12 July – Headline CPI (expect another large decline)

- 13 July – Producer Price Inflation (leading CPI indicator, currently negative)

- 26 July – FOMC meeting (75% chance raise, expect this to soften as inflation comes in soft)

Fundamentals

- BlackRock May Have Found a Way to Get SEC Approval for Spot Bitcoin ETF

- Hong Kong’s regulatory lead sets it up to be major crypto hub

- Crypto Exchange Backed by Fidelity, Schwab and Citadel Launches With Additional Investors

- A16z picks crypto-friendly London for first non-US base

- Polygon Takes Wraps Off Version 2.0 calling it “the value layer of the Internet.”

- Tech giant Alibaba announces crypto-friendly chair following Daniel Zhang stepping down

Market update

The decisions by the FOMC and the PBOC to ‘skip’ rate hikes and cut rates, respectively, signal that central banks are becoming more cautious about the global economic outlook. The war in Ukraine, rising inflation, and the slowdown in China’s economy are all weighing on growth prospects.

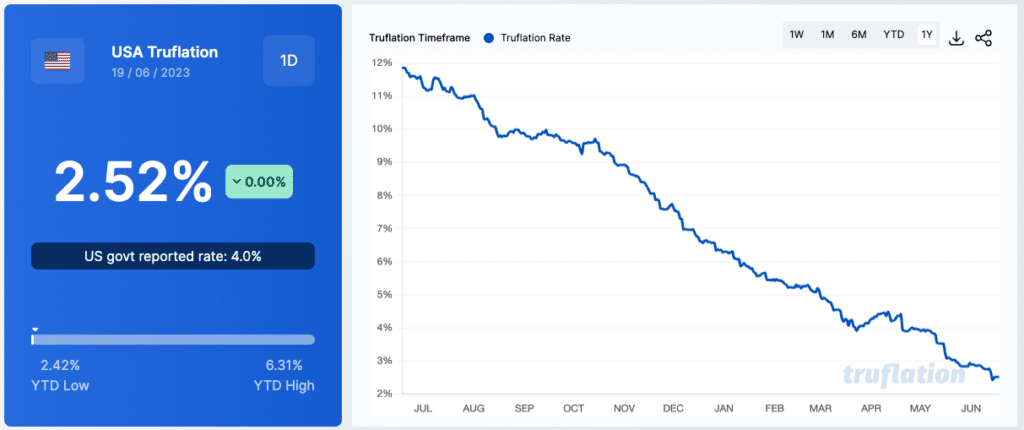

Headline inflation in the US dropped to 4%, and another large drop is expected next month, the Cleveland Fed are forecasting a drop to 3.2%. Truflation, a real time inflation calculator, calculates the current rate at 2.5% using more real time data than the Federal Reserve methodology. As such we expect the current ‘skip’ by FOMC to become a double skip, and then an offical pause.

The pause phase, which we believe we have just reached, is a historically good time for risk assets, mid 2006 the FOMC paused for about 12 months and the S&P500 rallied around 25% and the late 2018 pause saw a rally of a similar amount over 7 months. As credit tightening starts to bite earning are unable to keep up with rising stock prices and a correction becomes more likely, the risk of an liquidity event also increases with the tighter credit flows and may provide a catalyst for a sell off like the collapse of Lehman Brothers in 2008.

The BlackRock Bitcoin ETF application is very interesting for a number of reasons, Larry Fink as well known democrat donor, is a welcome supported on that side of the aisle. BlackRock have a 99% approval rate for ETF applications and very good relationships within the SEC, the application includes a ‘surveillance sharing agreement’ with NASDAQ to address the SEC’s primary concern (and rejection catalyst previous applications) of market manipulation.

The launch of EDX Markets is very big news, this is not just another exchange but the first for a major crypto exchange that replicates the non custodial approach of TradFi exchanges (i.e. users will have to use a financial intermediary the same way they do to access equity exchanges), this segregation of duties is a major bone of contention for regulators. Conservatively listing just 4 assets, Bitcoin, Eth, Litecoin and Bitcoin Cash, non of which are publicly opined by the SEC as securites.

While the US struggles to articulate it’s approach to the sector the UK is rolling out the red carpet via PM Rishi Sunak “As we cement the U.K.’s place as a science and tech superpower, we must embrace new innovations like Web3, powered by blockchain technology, which will enable start-ups to flourish here and grow the economy,” said as he welcomed prominent Venture Capital firm Andreessen Horowitz and crypto backer in opening their first international office in London.

Insights: Coinbase’s Fight Against the SEC

On the 6th of June the Securities and Exchange Commission charged Coinbase, Inc. with operating its crypto asset trading platform as an unregistered national securities exchange, broker, and clearing agency. The SEC also charged Coinbase for failing to register the offer and sale of its crypto asset staking-as-a-service program.

Coinbase has promised a vigorous defense against the SEC charges. “We are confident in our facts and the law,” Armstrong said in a tweet June 6. The company released a video it called “By the numbers” the same day. In it, the company said it mentioned staking 57 times in the S1 report it filed with the SEC before its initial public offering. Strange that the SEC would approve IPO and business model that it believes is breaking the law!

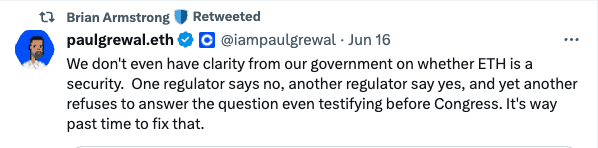

Furthermore, Coinbase “met with the SEC in 2022 asking for guidance” 30 times, the new video claimed. It also filed a petition for rulemaking on staking in March this year. Chief Legal Officer Paul Grewal pointed out in his June 6 appearance before the House of Representatives Committee on Agriculture that Coinbase is not currently unregulated. It is a registered money services business with the Treasury Department, and Coinbase Asset Management is a registered investment adviser with the SEC and a licensed designated contract market regulated by the Commodity Futures Trading Commission.

Gary Gensler, Chair of the SEC, has refused to provide any guidance to the crypto industry despite repeated attempts by market participants, instead suggesting the rules are clear and the 1933 and 1940 Securities Acts are sufficient to regulate blockchain technology. This is of course at odds with everybody else associated with the industry; the CFTC has stated it believes some crypto assets are commodities (and therefore not securities); there are over 30 bills with the legislative branch of government all aiming to provide clarity, other jurisdictions are creating new rules for this new asset class i.e. MiCA in the EU and Token Mapping exercise in Australia by Treasury.

There are mainstream reports that Gary Gensler has designs to become the next Treasury Secretary, which incidentally he was lined up for as part of Hilary Clinton’s 2016 campaign, and is simply doing the bidding of power brokers to secure their support. Either way we look forward to the courts having their say and less opaque obfuscation from the SEC Chair.

Podcast of the month:

Hong Kong’s New Crypto Regulation: Will It Attract the Industry?

On June 1, Hong Kong implemented new crypto regulations to license exchanges. Two experts – Angelina Kwan, CEO of Stratford Finance (and former COO of BitMEX), and Adrian Lai, founder and managing partner of Newman Capital – weigh in on the new rules in Hong Kong, which tokens can be listed, recent reports that China may be sanctioning this activity, and how the crypto community is responding so far. Plus, they dissect the latest developments of the digital yuan, whether China will ever embrace public blockchains, and the shifting global regulatory landscape for crypto, and more.

The Merkle Tree Capital “Why?”

We know accessing the digital asset sector is challenging, presenting a new set of risks that most investors are not familiar with, and there is a lot of sub-standard information flying around. That is why we created an actively managed unit trust aiming to hold the best digital assets that will form the basis of the ecosystem over the next 5-10 years.

Investors can now access this new asset class without concerns around self-custody or dealing with unknown counterparties, simplify their tax reporting, avoid single asset risk, maximise yield, and access institutional risk management and portfolio construction.

SMART – actively managed, enhance risk adjusted returns, sophisticated portfolio construction, staking yield, simple exposure – no passwords or digital wallets

SECURE – institutional custody, staking in cold storage, insurance, counterparty due diligence

CRYPTO – Blockchain eliminates intermediaries, lowers costs and improves efficiency by bringing transparency and security.

Thanks for reading!