The markets have been challenging of late. Amidst the inflationary macro backdrop impacting the markets broadly, crypto assets were hit particularly hard last week as the LUNA / UST algorithmic stablecoin experiment unravelled.

In this blog post I will explain a little bit about what happened with LUNA & UST and subsequently explain why situations like this are a stark reminder on why diversification and risk management are so crucial to a well-managed crypto portfolio.

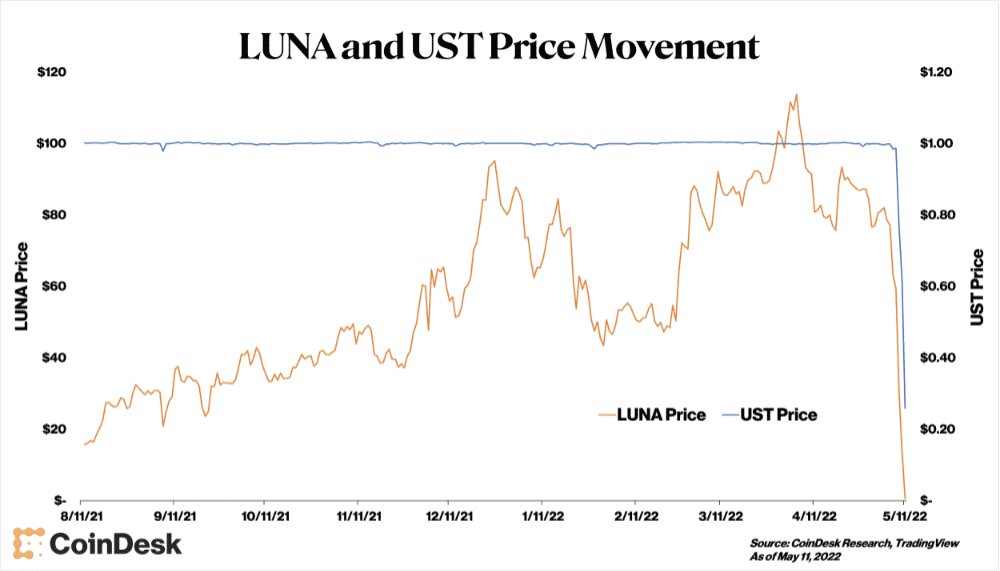

Firstly, what happened with Luna and UST? UST, a so-called algorithmic stablecoin, works with its sister token, LUNA, to maintain a price around $1 using a set of on-chain mint-and-burn mechanics. In theory, these mechanics are supposed to ensure $1 worth of UST can be used to mint $1 of LUNA – which serves as a sort of floating price shock absorber for UST volatility. Recent massive selling pressure led to sharp drops in the prices of both LUNA and of UST. Eventually, the market cap of LUNA flipped that of UST for the first time. When there was no longer $1 worth of LUNA for every $1 of UST, the entire system started to become insolvent (because UST holders would have no clear way to “cash out” into LUNA in the event of a full-scale bank run) and LUNA nose-dived from its highs of USD$119 in April 2022, to a fraction of a cent, with UST being valued at just 8 cents at the time of writing this post.

How did the MTC Digital Asset Fund avoid being exposed to LUNA / UST?

- Each coin that that we consider for investment is assessed against a strict set of criteria to determine whether we deem it investment grade. While the idea of an algorithmic stablecoin could be easily perceived as ‘sexy’ on the surface, or well aligned with the ethos of cryptocurrency and decentralisation, we were not comfortable with the complex tokenomics that underpinned it, nor the historic track record of algorithmic stabelcoins where demand shocks have led to a total failure shock. Despite the impressive growth of LUNA and UST both in terms of market cap and ecosystem adoption, for these reasons we made the decision to not invest.

- If an asset makes it through our investment screening process we manage our exposure risk through diversification, holding between 15 to 25 different assets in the fund at any time. Within this we have target allocations for each sub-category that we invest in (i.e. Currency, Layer 1, Defi/Cefi, Web3, Metaverse & Gaming) and allocate according to our investment mandate. In normal circumstances we are never exposed to a single asset by more than 15% of our overall portfolio and in many cases, allocations are significantly less.

It is human nature to chase the new shiny thing, especially when it’s pumped from $20 to $119 in just 6 months against the backdrop of a down-trending market, however times like these provide a good reminder that a disciplined investment process will outperform emotional trading over the long term.