The Crypto, or Digital Asset, ecosystem has been growing rapidly since its inception early in 2009 when the Bitcoin Network software was released, and Satoshi Nakamoto mined the first block (known as the genesis block).

The genesis block contained a text message “The Times 03/Jan/2009 Chancellor on the brink of second bailout for banks” a reference to the intended purpose of bitcoin, an alternative monetary system that is not beholden to banks, governments, bankers (central or otherwise) or the inherent risk of a fractional banking system which had just been laid bare in the 2008 Global Financial Crisis.

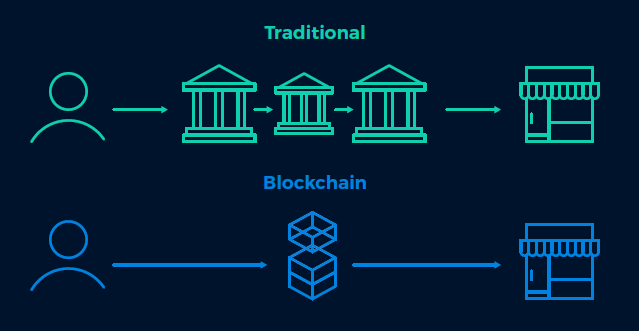

While the primary use case was transactions, bitcoin is a peer-to-peer payments system with store of value / scarcity qualities similar to a commodity like gold, new cryptocurrency projects like Ethereum took this a step further, adding smart contract functionality to a blockchain.

Bitcoin is both a payment network, like SWIFT (only faster, cheaper and more secure) and a currency like USD (only it can’t be censored or manipulated by a government or central bank) where bitcoin the currency is moved around the Bitcoin Network. Ethereum is often described as a planetary virtual computer, a simple analogy would be it’s a platform, like iOS or Android, it can host applications supporting ecommerce, IOT, supply chain solutions and gaming, to name a few, but instead of your data being hosted (and harvested) by big tech companies it is stored on a network of decentralized computers and protected by cryptography.

At a high level, this guide will:

- Provide an Introduction to Blockchain, Distributed Ledger, Cryptocurrency and Smart Contract technologies.

- Provide examples of current use cases and the industries they are disrupting.

- The investment opportunity and introducing cryptocurrency to a balanced portfolio.