Blockchain is an emerging technology that has the potential to make substantive utility and efficiency improvements in the real estate sector. This is the first part of a series where I will explore some of the potential use cases and how they might be adapted into the real estate industry starting with Investment Vehicles.

Investment Vehicles

Investment in large scale real estate, an inherently illiquid asset, requires a form of securitisation. Some of these aspects have been addressed over time with the creation of listed and unlisted REITs, however the hurdles associated with developing an investment vehicle, accessing capital and distribution networks and administering these investment vehicles remain significant.

This is particularly the case for investors wanting exposure to offshore real estate via cross jurisdictional investment.

Whilst the speed of adoption is likely to be slower in this space, the potential for disruption is clear.

As an example, blockchain may in time allow for the simplification of cross jurisdictional investment into pooled real estate investment vehicles.

There are currently significant barriers for cross border investments:

- Complex corporate entity and trust structures are required to facilitate cross boarder capital flows;

- Contractual rights are not just held in legal documents that are needed to be replicated in each jurisdiction, they also require specific and complex legal drafting in order to back to back these rights across multiple jurisdictions.

- This is costly, difficult to execute and carries additional risk (upstream and downstream errors)

- Corporate bank accounts are required in each jurisdiction that investors reside; and

- It is costly and time consuming to transfer funds between jurisdictions.

Due to the significant complexity and costs associated with providing cross boarder investment access to, for example, an Australian domiciled unlisted office sector investment Fund, investment in major real estate projects and assets is typically limited to institutional and ultra high net worth investors. It is worth noting that there are numerous examples of these institutional investment platforms ‘on selling’ the investment offering, effectively acting as an aggregator of ‘mum and dad’ investor capital to then deploy on their behalf…. thus clipping the ticket.

How Blockchain changes this:

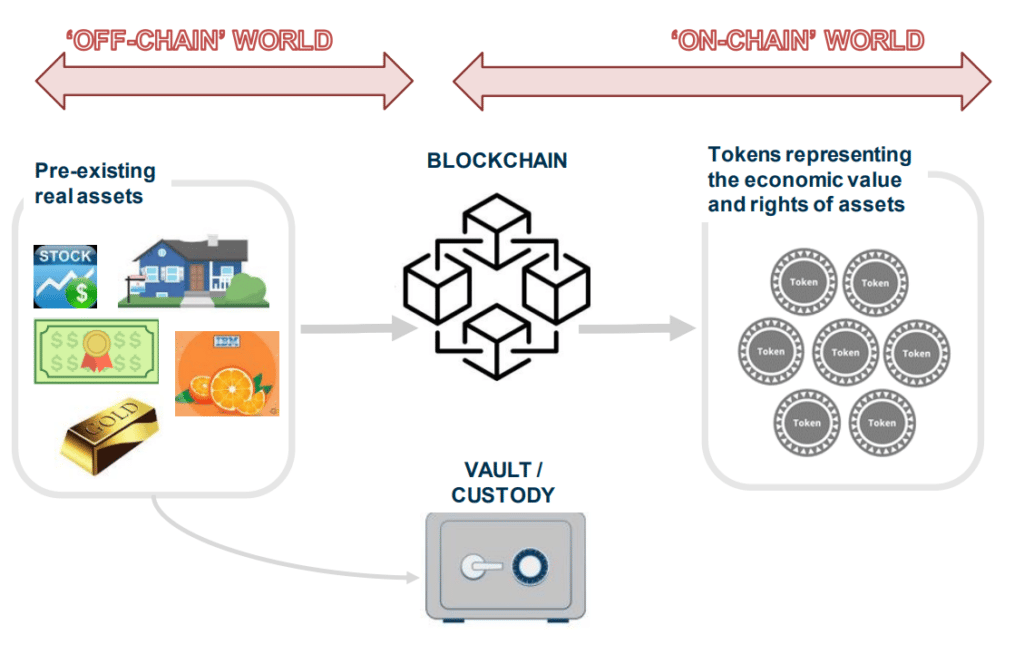

- It enables the tokenisation (blockchain equivalent of securitisation) of real assets (located ‘off chain’) via corresponding capital investment facilitated on the underlying blockchain.

The following diagram creates a basic illustration of the capital flows, whereby the blockchain replaces the current banking intermediary in the capital flow process:

- It would therefore be much easier to facilitate cross boarder capital flows via decentralised finance (i.e. USDC) – think close to instant transfer time frames and much lower costs associated with capital calls from investors and income/capital distributions back to investors.

- Digital assets can be programmed to include ownership rights, transaction history, and rules to ensure asset issuance, distribution and transfers are regulation compliant.

- Contractual rights are built into the blockchain, therefore eliminating the need to have ‘back-to-back’ legal contractual documents that exist in each jurisdiction (reduces risk across most facets of the investment).

- The simplification therefore allows access to a much wider and deeper pool of potential investors (global distribution network) with a much faster and cheaper transaction cost base and enabling significantly lower minimum investment amounts.

- This in turn would lead to efficiencies and significantly reduced up front and ongoing costs.

- Importantly, it is fully transparent and therefore can provide a pathway to improved KYC/AML monitoring.

- It improves the ability to easily manage cross boarder distribution entitlements and payments.

- By having interests that could hypothetically be traded on the blockchain in any jurisdiction, in theory there could be potential for greatly increased investor liquidity into these investment structures. Importantly these investors would be able to elect to participate directly in the investment rather than using an aggregator investment intermediary.

Whilst we are only at a nascent stage in terms of blockchain development and its evolution, already we can identify a world in which blockchain technologies will potentially fit into the future world of bricks and mortar real estate.

In the next part of this series I will explore Smart Contracts and how they will facilitate a move away from paper legal documents and provide a platform that acts as a single source of truth for all real-estate based contracts.